[EN] Rate hikes snapshot. July 2023

A snapshot of the economic situation for the first half of the year ahead of the FOMC and ECB Executive Board Meeting, which is expected to increase interest rates.

Disclaimer: The article looks so voluminous thanks to a sufficient amount of visuals. Don't let that scare you.

On the eve of the upcoming FOMC meeting, it is no secret to anyone that most market players expect an increase in the Fed's fund rate. This state of affairs comes from both the hawkish statements of Powell and most of the chairs of the Board of Governors and from the current macroeconomic situation. However, one of these days, an increase is expected immediately on both sides of the Atlantic, which adds some intrigue to the behaviour of both the EUR-USD pair and the dollar index (DXY), in which the weight of the euro occupies the lion's share.

In order to understand what scenarios a major currency pair can expect in the medium and long term, I propose to go deeper into the geopolitical and macroeconomic context of both the US and Europe, and the world as a whole.

Prologue

Let me start by saying that the main macroeconomic issues of the central banks (both the ECB and the Fed) to manage are the fight against inflation and unemployment since both of these aspects play an important role in ensuring stable economic development and prosperity.

Undoubtedly, the formation and implementation of monetary policy, the regulation of the banking system and the management of foreign exchange reserves are also important, but to a greater extent, they are aimed at achieving a state of balance in the economy, both in terms of optimal employment and in terms of development pace. Therefore, in the analysis, we will focus our attention on these two main factors.

The US Federal Reserve, like the European Central Bank, is also aiming to keep inflation moderate at around 2%. To do this, monetary instruments (changes in interest rates, open market operations and reserve requirements) are used to control the money supply and influence inflation.

As for unemployment, the situation is slightly different. The Fed's dual mandate includes controlling inflation and maintaining maximum employment. When making monetary policy decisions, the Fed takes into account data on employment and unemployment, seeking to maintain stable inflation and stimulate the economy to create jobs.

In the case of the ECB, there is no explicitly mandated goal of controlling the unemployment rate. However, his monetary policy is aimed at ensuring price stability and the macroeconomic situation in the euro area, which, in turn, may affect the level of employment.

Having analyzed the main levers of influence and the logic behind the change in interest rates, we can proceed directly to the analysis of the situation.

Rate

The main theme of the week is, of course, the rate. For both the EU and the US. And in the case of the next committee meeting, there are no secrets. The FedWatch Tool from CME Group, for instance, reports us about 98.9% of the surveyed market participants expect the Federal target rate to rise at the level of 525-550 basis points. And in the case of the ECB, it is even more prosaic, they do not hide their intentions to raise the refinancing rate in the coming days.

The question is rather how long it will continue. And why, in general, regulators are still forced to tighten their monetary policy by increasing the cost of loans. In order to answer these (and not only) questions, I propose to go over the impact that a change in the discount/refinancing rate has already had on the economy.

Unemployment

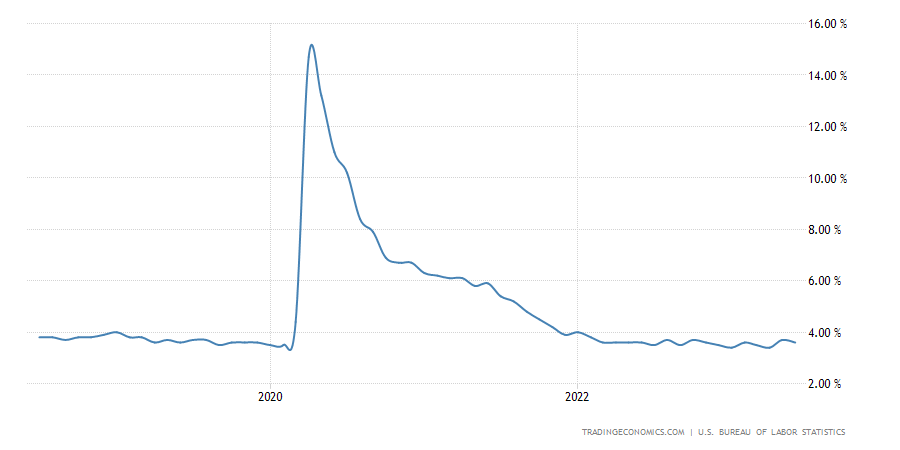

Let's start with the labour market. In this case, the situation on both sides of the Atlantic is the opposite. While the United States sees the problem of historically low unemployment rates hindering an effective fight against inflation, in Europe the unemployment rate is generally above the 5% target and varies from country to country.

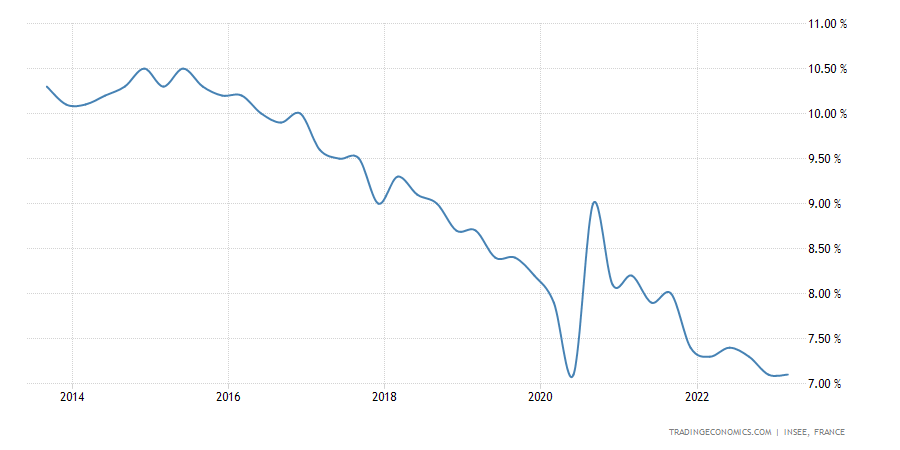

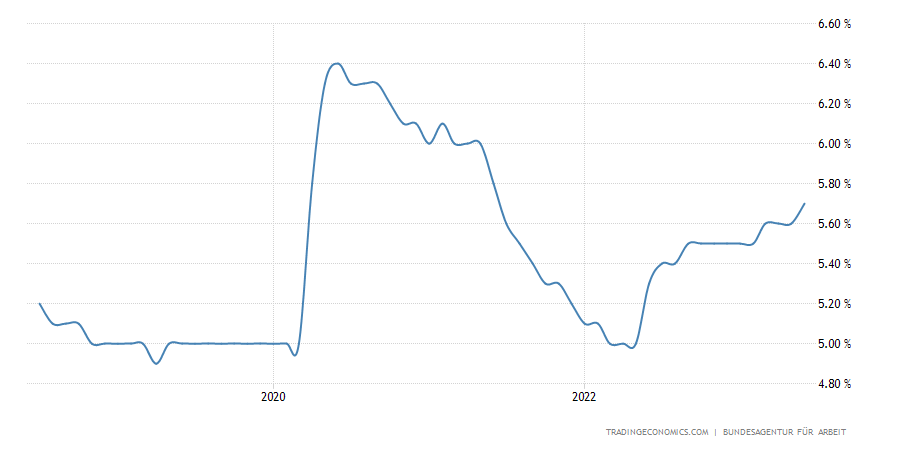

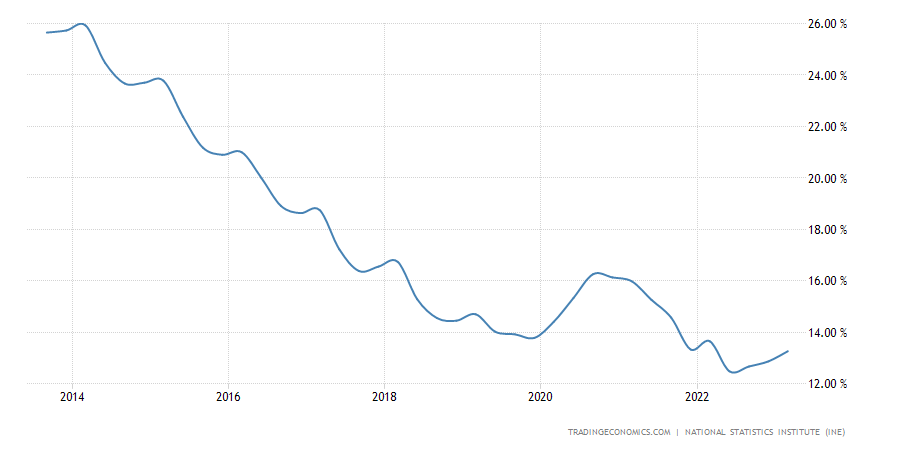

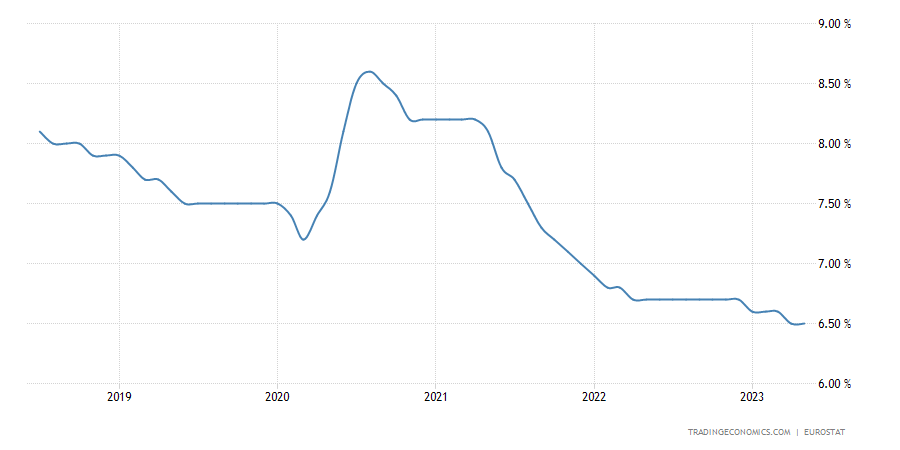

As a result of the global financial crisis (GFC), the employment situation in Europe was more tense. Gradually recovering from the crisis, the region faced a new challenge in the form of a pandemic, which caused a noticeable increase in the number of unemployed people.

The war unleashed by Russia against Ukraine at the beginning of 2022 also contributed. And if in France the growth of unemployment was contained, then in Germany there is a noticeable increase, not to mention Spain.

As I have already mentioned, in Europe the unemployment rate varies from country to country, and the aggregate figure for the whole EU has been at the level of 6.5-6.6% for a long time.

But what about the United States? In contrast to the European Union, the US economy is experiencing record employment. Maintaining the current unemployment rate, the pace of achievement of which was good for the recovery of the economy after COVID-19 is now playing a bad thing. By fueling sticky inflation, the current state of affairs is forcing the Fed to take more drastic measures.

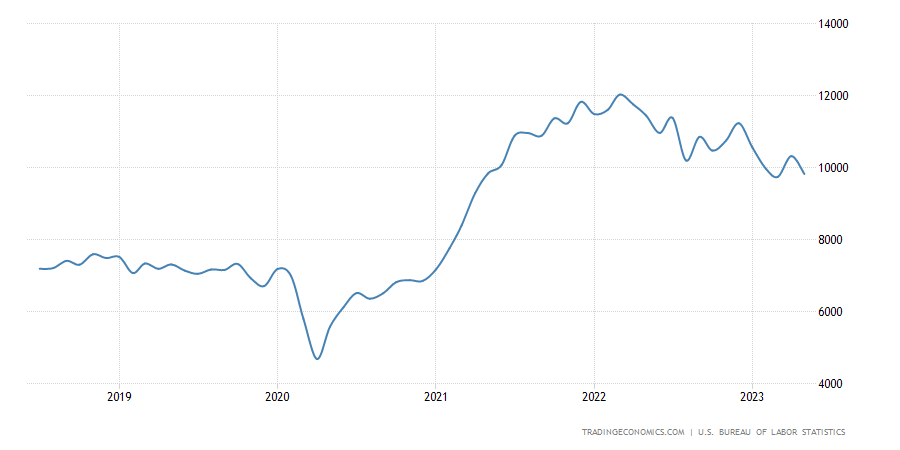

The tense situation in the labour sphere is also described by the statistics of the number of open vacancies (Job Openings). Although the indicator data has a pronounced downward trend from its February peak (2022), it still shows a significant number of open positions companies trying to fill with applicants.

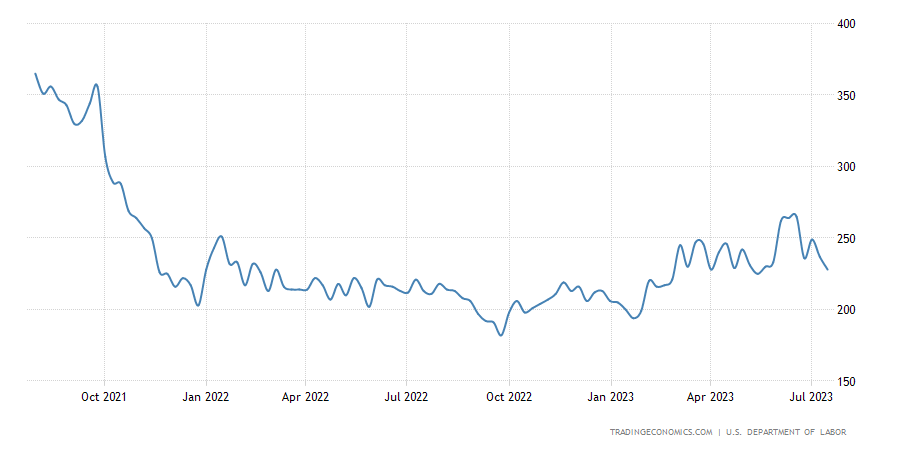

In order to monitor the situation in the labour sphere, the number of initial claims for unemployment insurance is taken into account. This information is published by the US Department of Labor on a weekly basis and allows you to follow the changes in real time.

As we can see from the graph above, there is no particular increase in people who have lost their jobs. The values are in the range of 200-250K per week, while for some noticeable change, I would like to see a trend towards 300K+ claims.

Economy

Unemployment and inflation are inextricably linked with the performance of the service and manufacturing sectors. For both geographies we are considering, the service industries occupy a predominant role in the structure of the economy. They account for about 70% of the EU GDP and 80% of the US GDP (and the same share of employment in the respective areas).

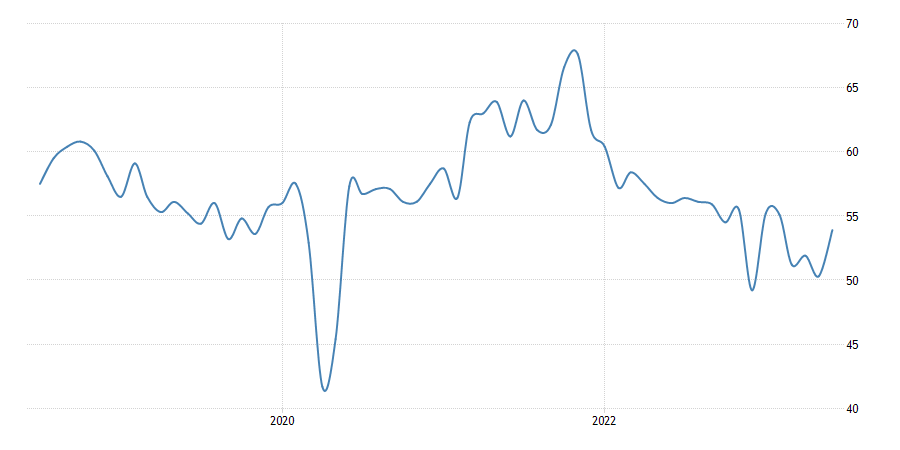

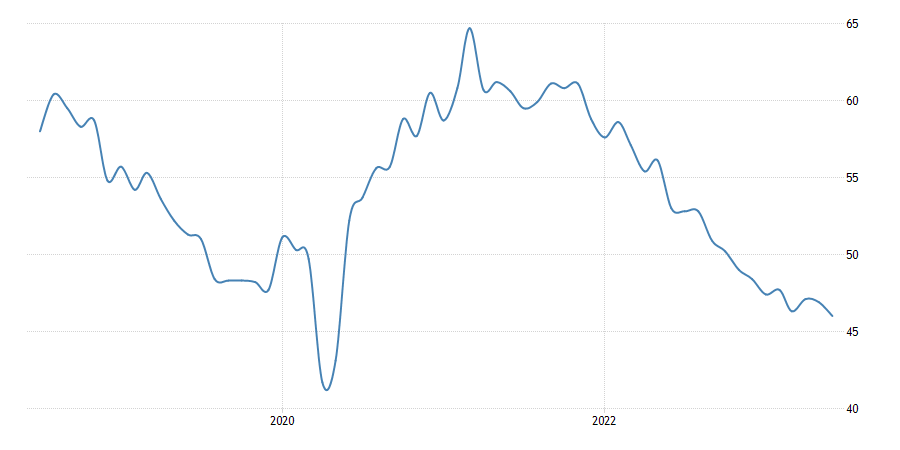

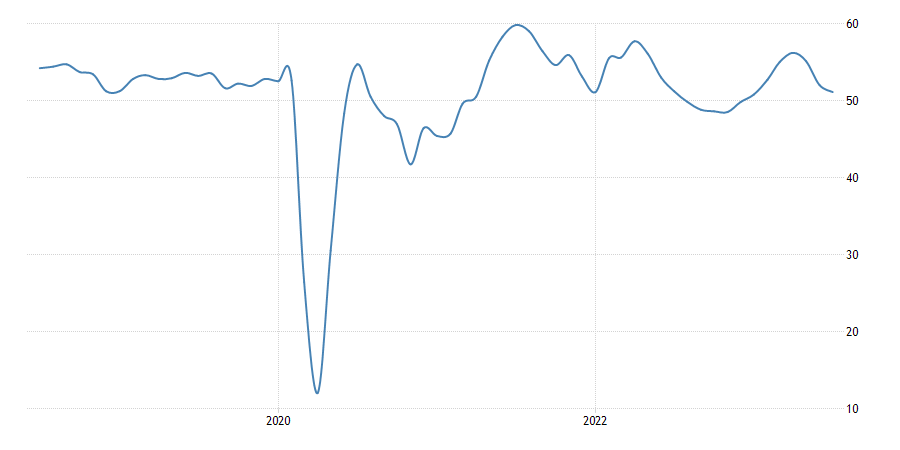

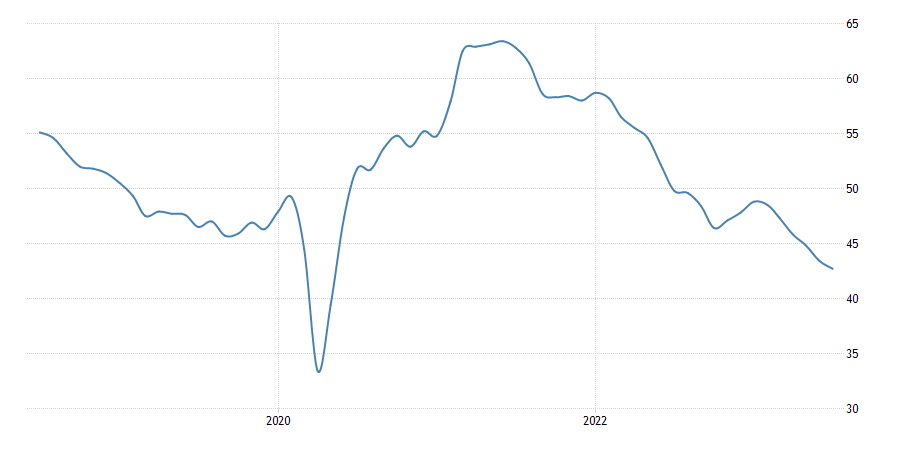

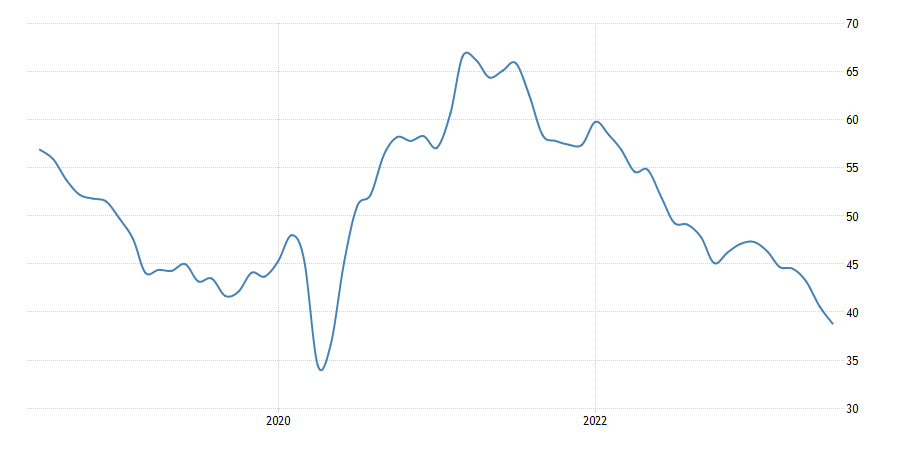

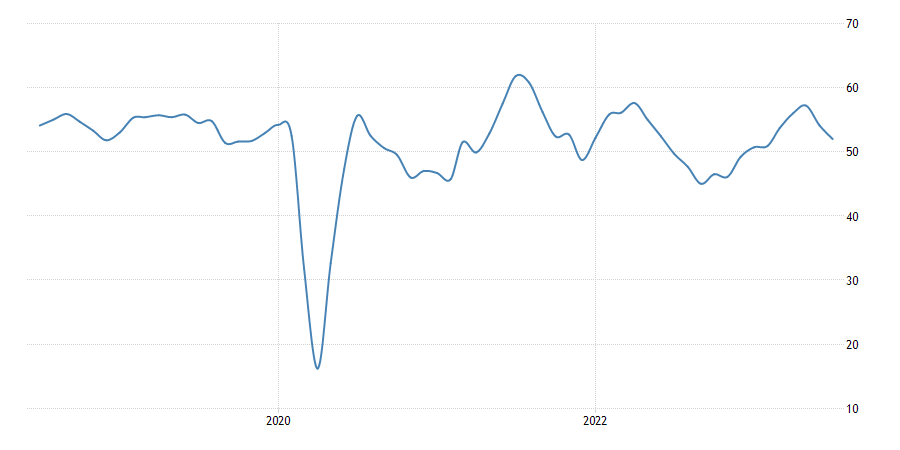

To visually assess the state of the above areas for the US and the EU (by country), I suggest referring to the business activity index called PMI. A level of 50 points is an equilibrium, and a deviation up or down indicates an improvement or deterioration in business sentiment.

As we can see, the service sector in the United States, although it was negatively influenced by geopolitical and economic factors of 2022-2023 (war, oil production, logistics, etc.), nevertheless feels much better than the manufacturing direction of the economy.

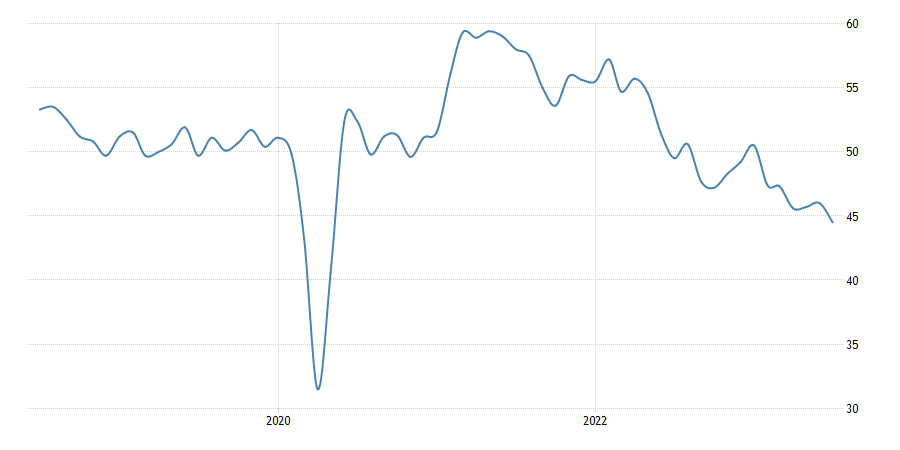

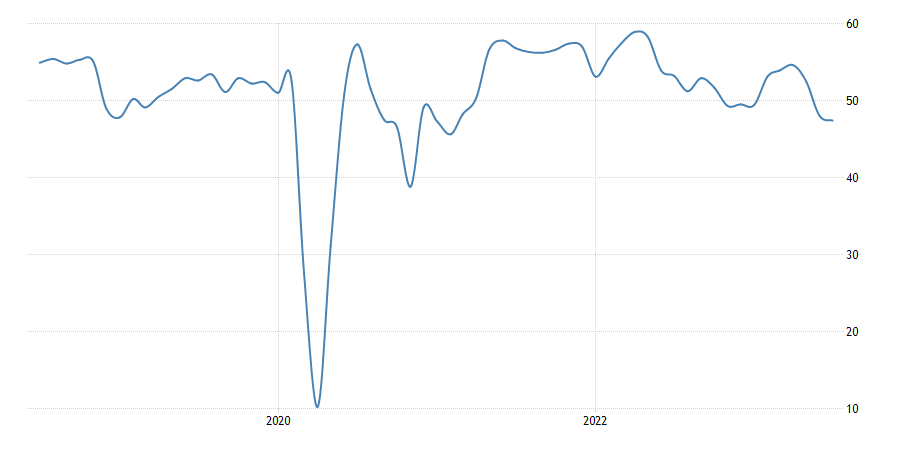

An absolutely similar situation is developing in Europe, whose industry was even more exposed to the negative influence of the factors mentioned earlier.

It is important to note that when comparing the two locomotives of the European economy - France and Germany - the following fact becomes clear.

The performance of the service sector for both countries is quite comparable, while the crisis has had a stronger impact on manufacturing in Germany than in France. This is due both to destroyed supply chains (supplies of gas, metals, raw materials for production, etc.) and to a drop in demand for products from China's side, which I will mention in more detail below.

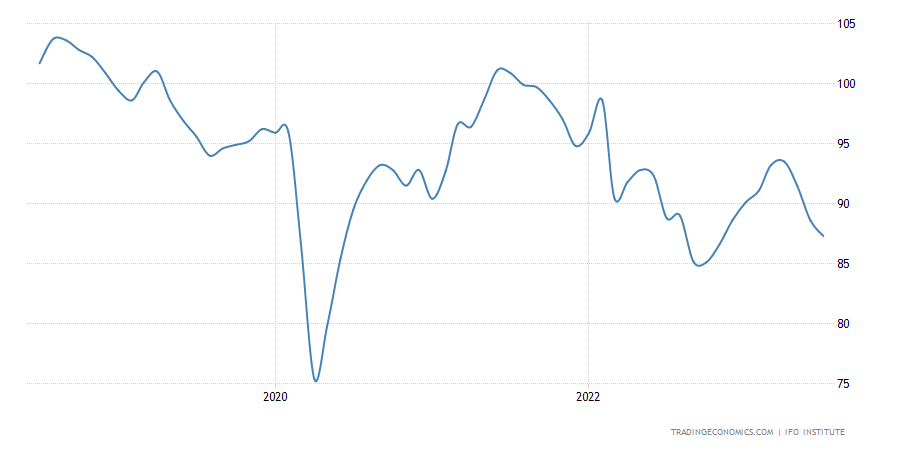

The latest data from the Germany Ifo Business Climate Index also suggests that the road to recovery in Europe's largest economy may be longer than originally thought, given continued inflationary pressures and rising borrowing costs, which will further increase with the refinancing rate hike at the next meeting.

Real estate market

An additional indicator to keep your eyes on the situation in the economy is the housing sector.

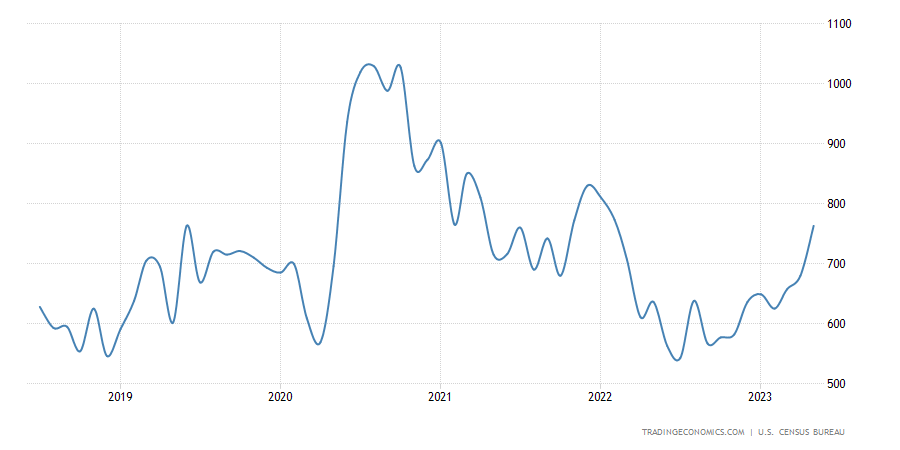

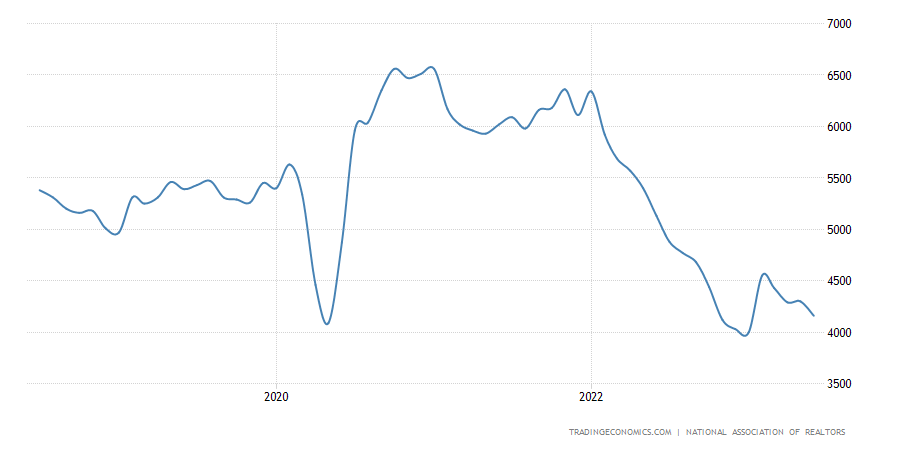

The statistics of new home sales at first glance look quite optimistic, taking into account the growth of more than 12% in June. High mortgage rates remain a major affordability issue, although some experts say there are signs that the housing sector has not only bottomed out but could start to fuel economic growth in the long run. However, if you look at the situation more broadly and take into consideration also the existing home sales, then everything changes in the opposite direction.

It should be clear that new homes make up a much smaller share of the total housing stock than homes sold on the secondary market. The structure of home sales may have changed due to the reluctance of owners to put their homes up for sale in the face of high-interest rates. They may simply not be interested in doing so, as high interest rates can reduce the demand for housing, and therefore make it harder to sell or ultimately reduce the cost of selling.

Price Indexes

Considering the situation in the economy, you are unlikely to be able to adequately do this without consumer price indices and producer prices in their various interpretations. Let's start with the simplest indicator - the consumer price index. More precisely, measuring its growth (both annual and monthly) will allow us to assess the pace of price growth for a wide range of consumer goods, that is, to measure inflation.

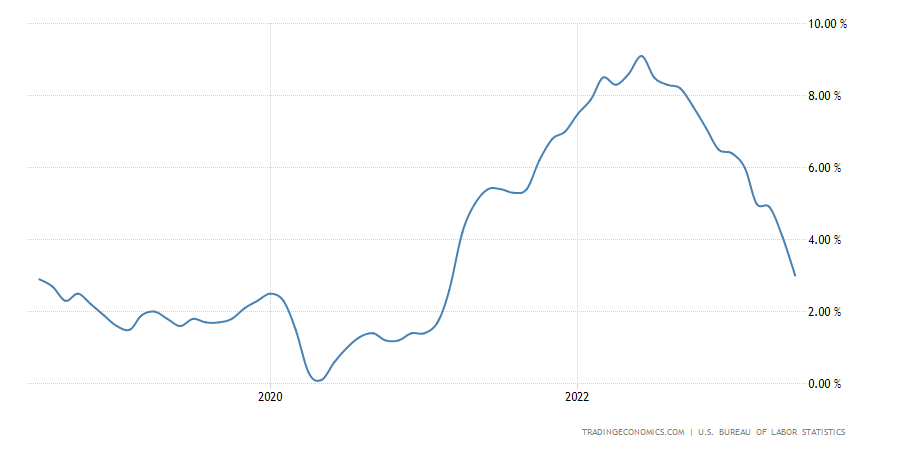

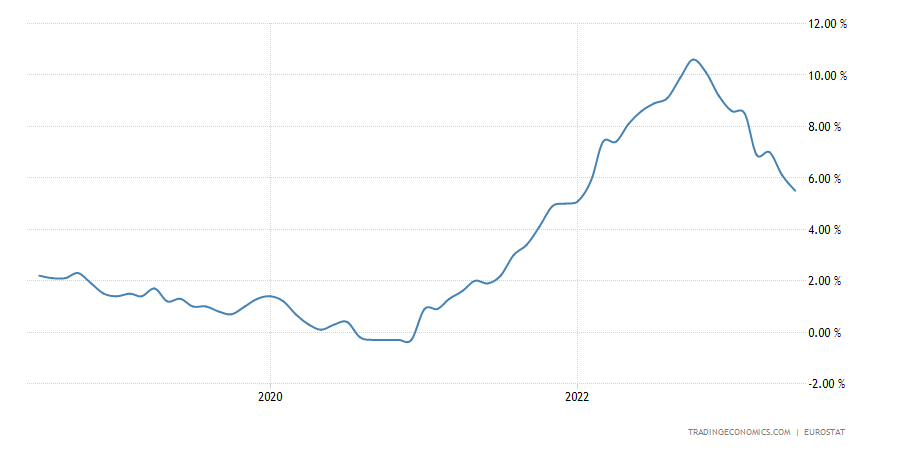

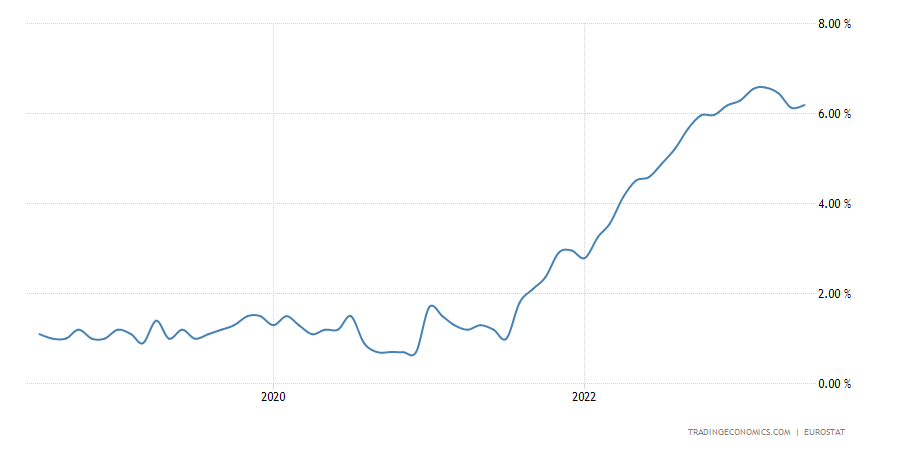

As you can see from the charts above, the US annual inflation rate slowed to 3% in June 2023, the lowest level since March 2021, down from 4% in May 2023. For the EU, this indicator is also experiencing a decline, but its pace is not as rapid as in the States. This is due both to the geopolitical and regional economic environment and, in comparison with the US, the pace of response in monetary policy to cope with the emerging problem.

Nevertheless, core inflation, which excludes volatile items (such as food and energy), climbed to 5.5%, remaining close to the recent peak of 5.7% and confirming the view that ECB policymakers are likely to continue raising rates in the coming months. While in the US there is a certain downward trend in the Core Inflation Rate.

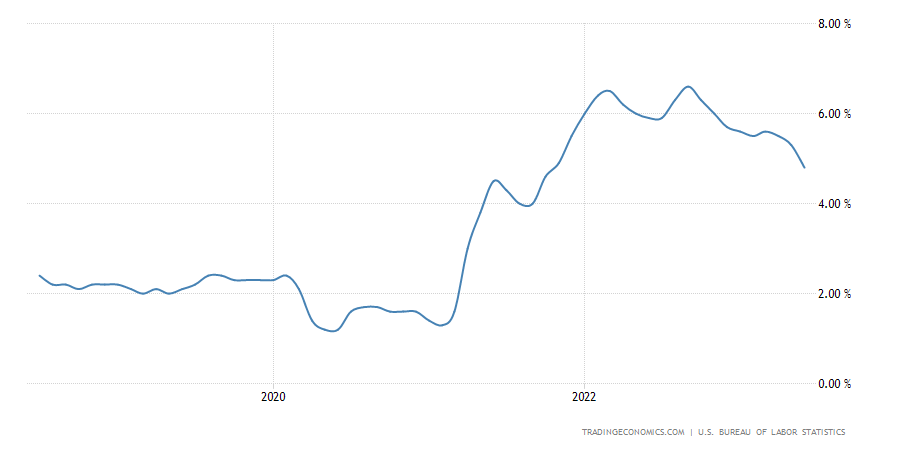

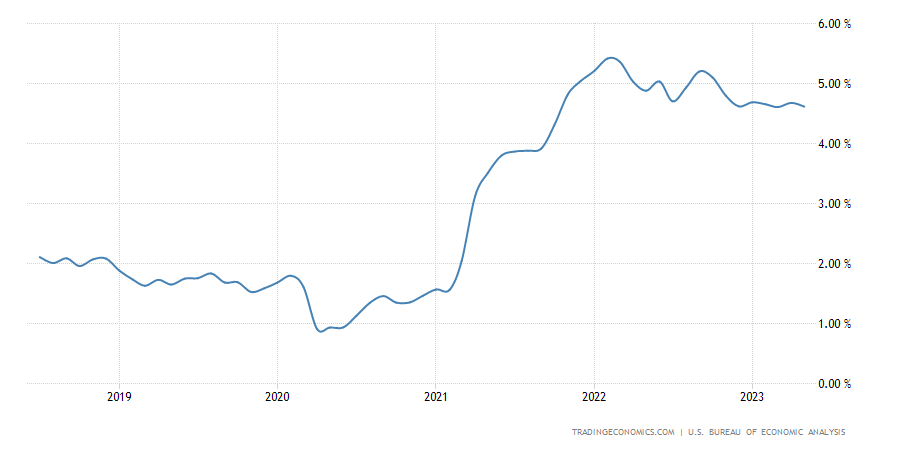

To delve deeper, let's take a look at the indicator that the Fed directly takes into account when planning changes in its policy. This is the PCE (Personal Consumption Expenditure) Index, which allows you to evaluate the prices paid for purchases of local goods and services.

Whereas the Consumer Price Index assumes a fixed basket of goods for analysis and uses spending weights that do not change over time (sometimes for even several years), the PCE Index relies on current and previous period consumers spending data to dynamically measure spending items.

As we can see, there is no movement towards 2% (the inflation target for the Fed) and we are not even close to it. While the value of this index fluctuates at the level of 4.5-4.6% in recent months, weakly reacting to the increase in the fund rate, some market participants assume another increase in the Fed fund rate this autumn (+25 bp). But where the market is unanimous is that after the next increase, the rate will be held at the same level at least by the end of the year. Actually, we have heard about this many times from the hawkish statements of J. Powell.

Global pressure

The factors discussed above allowed us to look at the situation from the inside. But the world is a dynamic and complex system of connections and interactions, so the global context should also be taken into account when assessing further options.

2022-2023 for the world can be characterized as a period of wars, upheavals, cataclysms, confrontations, sanctions and declines, and something positive hardly comes to mind. The second-largest economy in the world — China — has also contributed to the economic development of the United States and Europe, being their main counterparty in international trade.

Everyone was betting on the strong growth of the Chinese economy after the removal of all quarantine restrictions and the abandonment of the Zero COVID policy. According to the results of the first half of the year, the leading investment banks cut their forecasts. Domestic demand is what is called hibernation, imports are declining, the bubble in the residential real estate market, despite all the efforts of the Communist Party, is not gone, every fifth representative of the youth is out of work, and international corporations, against the backdrop of confrontation with the Western world, are in a hurry to relocate their production to neighbouring, more loyal and stable countries like Vietnam. Talking about some rosy prospects, I think, is not worth it.

The redistribution of raw material flow chains against the background of the war unleashed against Ukraine also makes itself felt in the European economy. The supply of gas and oil products still requires new counterparties and diversification of possible risks, and rising prices against the backdrop of an increase in the cost of energy sources have a negative impact on society with an already noticeable level of unemployment.

Violation of the supply chain of agricultural crops to the world market, forcing the militaristic attitudes of Iran and its associates around Israel, and the reorientation of key players in the Middle East towards Beijing create a list of urgent problems for Europe that need to be addressed “yesterday”.

All of the above, although to a lesser extent, also applies to the States. The upcoming presidential race will also make its own adjustments to the current policy in the international arena and will certainly become a close object of attention immediately after the fate of the seat in the White House for the next term is decided.

Outcomes

Summing up the above factors in the context of their influence on the main EUR-USD currency pair today, I would like to note a few things. First, the analysis shows that the Fed is more decisive and quicker in dealing with deviations in fundamental economic indicators when compared with the actions of the ECB. Despite the possible further increase in the refinancing rate in the EU (against the background of a consistently high or even declining Fed discount rate), it is difficult to say unequivocally that European securities will be more attractive to investors, taking into account the entire external context. Which in turn does not give strength to the euro.

Secondly, soft landing, which the Fed representatives again began to recall, is becoming more possible, albeit in a very exaggerated concept. Decreasing inflation and a strong labour market, in my opinion, in the long term, is still more conducive to economic development than the combination of high inflation and high unemployment in Europe at the same time.

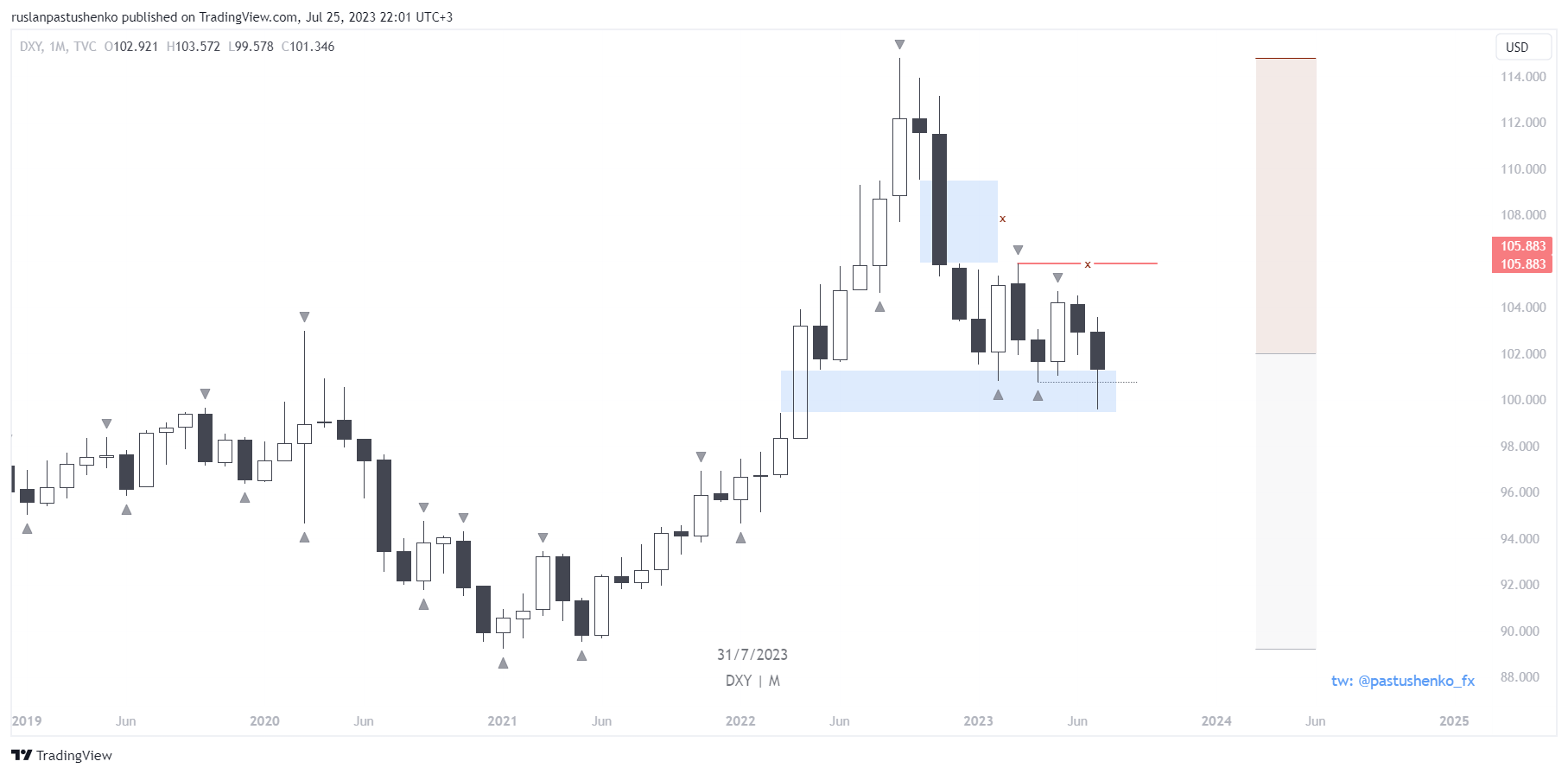

Taking into account the DXY chart, the factors mentioned above fit into the scenario in the medium term for its value to grow to 105 or more. For all the same factors analyzed above, the position of the euro against the dollar has every chance of weakening in the second half of 2023 - early 2024 as well.

Whatever the case, this is a snapshot of economic events as of July 26, 2023, ahead of the FOMC meeting and Powell's speech. As I have already said, the economy is a complex and dynamic thing, therefore, under the influence of various changes (local or global), adjustments can (and will) be made to the scenario considered above.

Not financial advice

DYOR