[EN] US Debt Ceiling. All you need to know

A comprehensive overview of the recent US debt ceiling crisis and its implications for global financial markets.

Being involved in the financial markets and the economic context for various reasons, you should definitely have noticed how the information noise has been increasingly centred around the ceiling of the US government debt. “The country is waiting for a default!”, “This will be a blow to the entire global financial system”, “Time is left until June 1…” and hundreds of other similar headlines — all this was full of editorials from world financial (and not only) publications, further heating up the situation.

To my surprise, some of my “craft colleagues”, who trade in daily the currency and stock markets, at best fell for the bait of this collective insanity when they commented on what was happening in the public plane. Sometimes it even came to the spread of entirely ignorant assessments and misconceptions, based only on emotions and bias, but not on a strictly analytical approach, evaluation of cause-and-effect relationships and dry calculations. There was enough hype, and you could probably notice it.

In our business — trading — this approach does not bode well and lays the foundation for only a one-way path. Moreover, not the most rosy, if we talk about the financial and psychological components. I want to correct this situation and therefore in this article, I offer my detailed view of the past (or not yet?) crisis of the US national debt ceiling.

You will learn why debt is actually not so bad for countries; how many times the US Congress actually had to raise the national debt limit; why you need to remember the coronavirus in the context of public debt; and what awaits us in the markets in the coming weeks and months.

Hi! My name is Ruslan. I have more than 5 years of experience in the financial sector, business consulting and IT projects, supported by higher economic education. During this time, I had the opportunity to immerse myself in various sectors of the economy, solve various problems within a particular business and analyze situations on a macro scale. Now my sphere of interest lies in the plane of trading in the currency and stock markets.

Since I see the need and importance of an accessible and reasoned delivery of quality information to a wide range of people interested in this area, I also share all my accumulated knowledge and experience within the Mirror Reflection community I am being a member of. From now on, I will do this from time to time here on the resource that you are now reading. Welcome and let's shed light on the real state of affairs together - without unnecessary trash and pathos, but with fact-checking and an explanation of the practical consequences.

The debt ceiling regulation in the United States is complex and its importance is really difficult to overestimate. However, I'm not talking about the sharpened debate “Will they make a deal or they won't?” because everything was quite obvious and unambiguous there (arguments are further in the text). I am now talking about the further impact of the deal adopted in the current framework, which will affect both the financial sector (derivatives markets, currencies, indices, commodities) and the economy as a whole (from the simple life of ordinary citizens to the functioning of enterprises and organizations).

Hereinafter, I will try to avoid using convoluted economic definitions that may be incomprehensible to a wide range of readers. If I still have to mention them, then detailed examples will be given so that you do not miss any details.

So, let's get started.

Importance of Debt

It should be said right away that the presence of public debt is not automatically something bad or terrible for the country, no matter how it is covered in the media. For that reason, let me touch on quite a bit of theory.

Its existence primarily allows governments to finance various programs and infrastructure projects. This may include education, health care, social protection, investment in the economy and other important areas. With borrowed funds, the government can provide citizens and society with the necessary services and support, which contributes to economic growth and prosperity. Ultimately, this leads to an increase in tax revenues and, ideally, a decrease in that same debt.

In some cases, public debt can serve as a tool for maintaining economic stability. A temporary increase in debt can help weather financial crises, support the banking system, or stabilize the economy during periods of recession. This can help preserve jobs and prevent a major economic downturn.

In addition to their direct, targeted functions, government bonds and other debt instruments, thanks to which government debt is formed, are an important part of financial markets. They provide investors with the opportunity to place their funds in government securities and receive income in the form of interest. This may be especially important for developing countries that need funding to grow their economies. Proper debt management and fiscal discipline allow countries to use these funds for investment and growth, rather than gobbling it up in order to cover current costs.

Public debt can also serve as an indicator of a country's creditworthiness. Countries with sound and stable economies are usually able to borrow money on better terms. Proper public debt management and debt repayment contribute to maintaining a positive credit rating and creditor confidence.

It is important to note that the size of public debt in itself is not a determining factor in its impact on the country's economy. The country's ability to pay interest on the debt and its timely repayment are crucial. To make it clearer, let's take a quick look at the example of several countries.

Japan, for example, has one of the highest public debt levels in the world, exceeding 200% of GDP. Despite this, the Japanese economy remains stable. Japan enjoys a high degree of confidence from international investors, which allows it to issue bonds at low-interest rates. What is the cause? Its economy is based on high productivity, innovation and exports, which contributes to income generation and facilitates debt management.

Germany also has a significant level of public debt, amounting to about 70% of GDP. Nevertheless, Germany has one of the strongest economies in Europe and is considered a reliable borrower. Why? The thing is that its financial stability is based on high productivity, export orientation and an effective taxation system. In addition, low-interest rates on German Eurobonds reduce debt servicing costs.

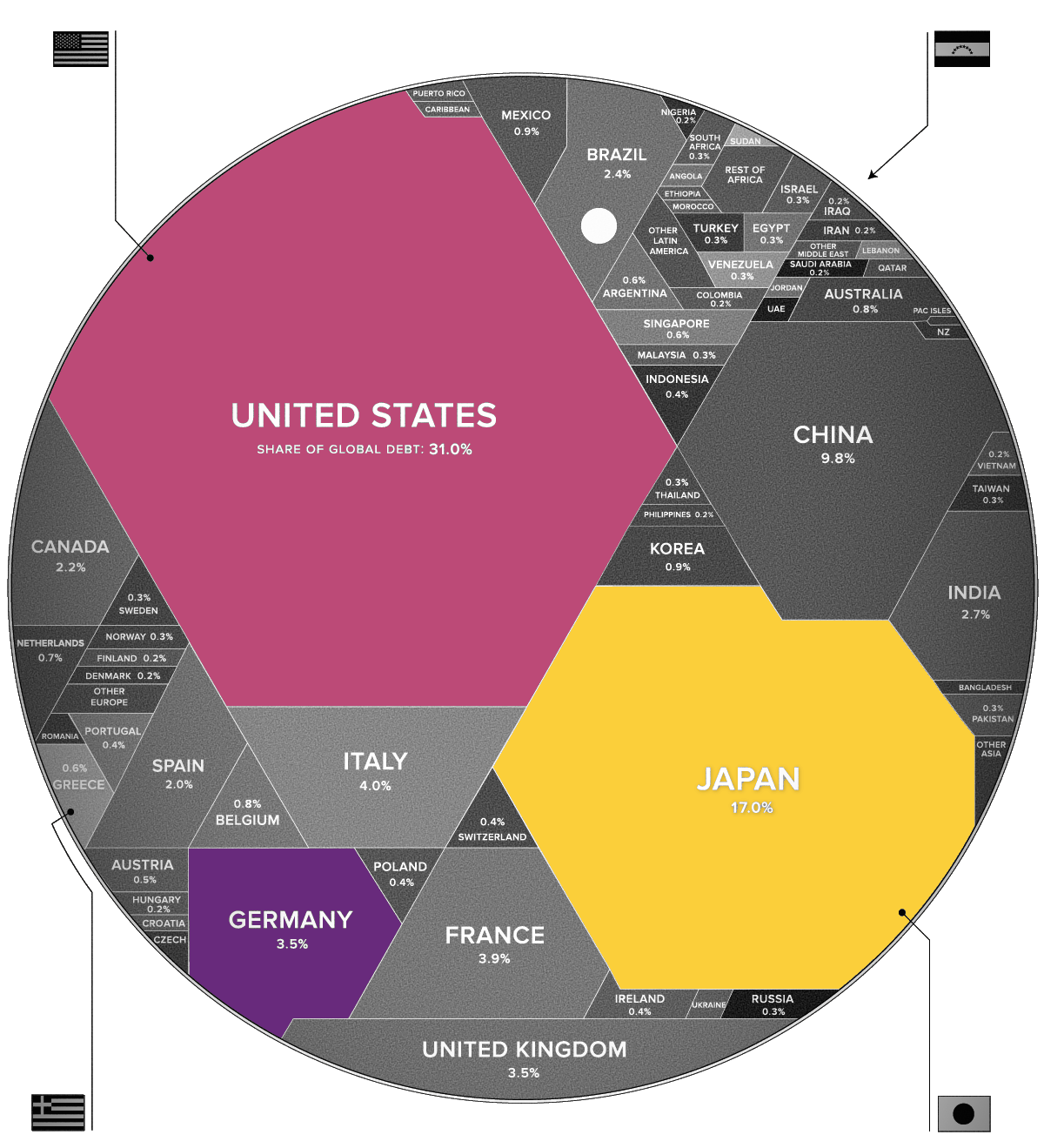

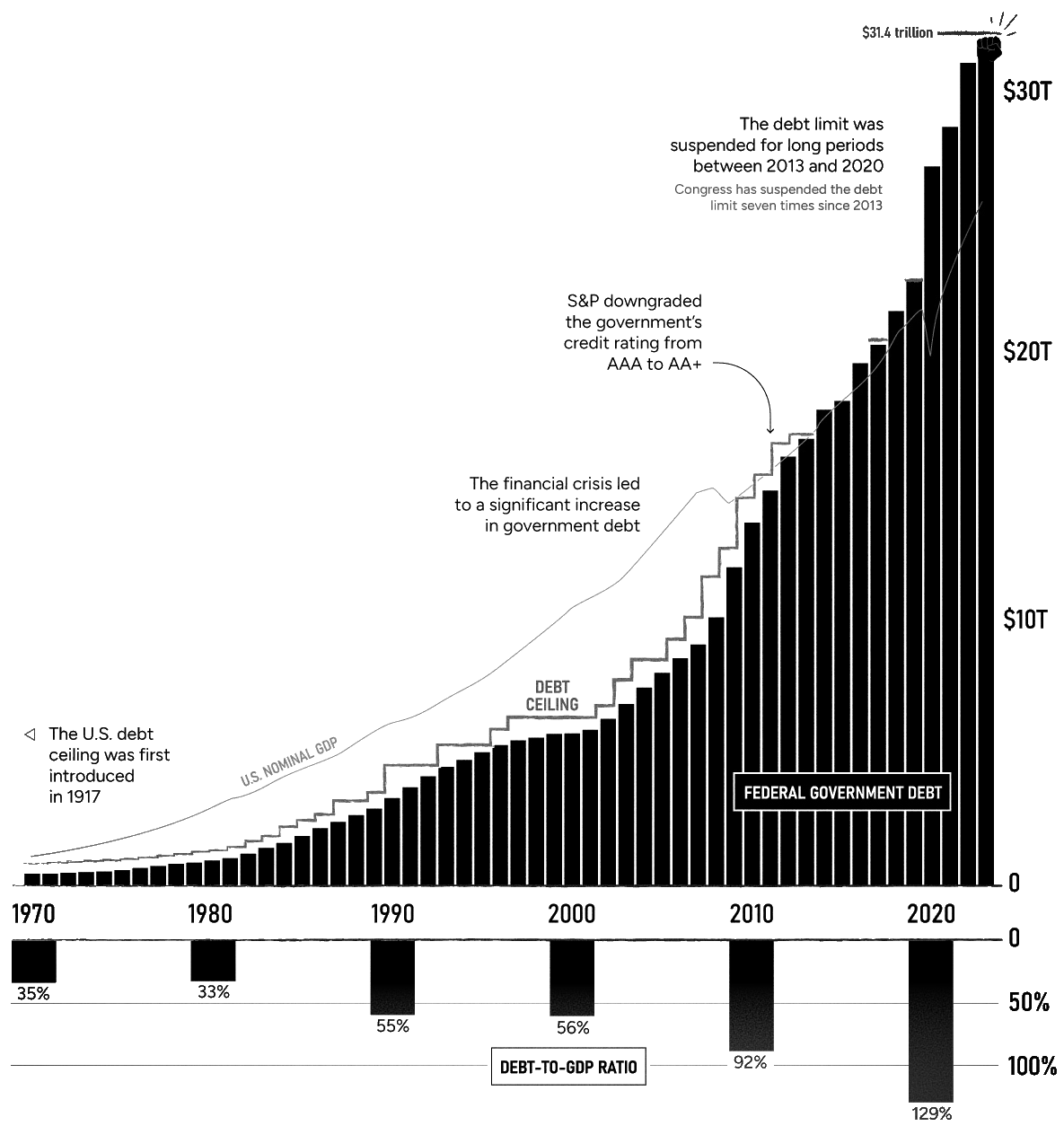

And, of course, the United States. The US has one of the highest public debt levels in the world, both in absolute terms ($31.4 trillion at the end of 2022nd) and relative to GDP (over 100% of GDP). However, the US continues to attract investors, and its government bonds are considered one of the most reliable assets. What is it based on? Of course, with the role of the dollar as the world's reserve currency and global demand for US securities. In addition, the United States has a developed and diverse economy built on an innovative approach and entrepreneurial spirit (yep, the “American dream” is about it too). In short, this provides income for the subsequent payment of the debt.

Obviously, giving the opportunity through loans to stimulate the economy is great in itself, and the absence of such an opportunity can be fraught with negative consequences in the long run. While working at Big4, I was convinced in practice that a lack of borrowed funds can lead to even more serious economic problems than its excess — there is a risk of missed opportunities. This is equally applicable both at enterprises and the states levels.

The main question you should be asking yourself in the context of debt (government or any other one) is whether the borrowed money is being used productively enough to generate the required return to pay the interest.

It is important to note that there is a limit beyond which a continuous increase in public debt can become a problem. High levels of debt can reduce investor confidence and increase debt servicing costs. Therefore, governments must ensure sustainability and moderation in the management of public debt in order to minimize risks and ensure long-term financial stability.

Keep this in mind. Until then, I won't bore you too much. We walked through the basic theory, and move closer to the subject of our conversation.

Back to History

First, I consider it necessary to touch on the history a little, so that you better understand what is what and where all this fuss comes from.

Initially, as far back as 1790, the American government was in debt as a result of the Revolutionary War, and also because of the financial difficulties that it encountered in the process of establishing a new country.

The main reason for the introduction of public debt was to provide the necessary funds for the development of the country's economy and infrastructure. The creation of public debt has allowed the US government to raise capital from various sources, including domestic and foreign investors, to finance projects and meet budgetary needs. Actually, the logic was laid there the same as I described above.

Over time, the US national debt has continued to rise due to various factors such as the financing of wars, economic crises, the promotion of social programs and the ongoing fiscal policy. Congress essentially had a free hand in the management of the country's finances.

During the First World War, when significant financial resources were required, the US Government began to actively borrow money to finance its military spending. Therefore, the desire to control the federal deficit and ensure financial discipline prompted the establishment of a debt ceiling.

It was introduced in 1917 with the passage of the Debt Ceiling Act. This law provided the US government with a cap on the maximum amount it could borrow through the issuance of bonds and other debt instruments.

Since then, the national debt ceiling has been periodically raised or suspended by law. This allowed the US government to continue to borrow money and cover budgetary expenses without exceeding the established ceiling and without violating any legal framework. After the end of World War II, it was changed more than 100 times. Just an interesting fact, nothing more.

But there is another, not very often mentioned reason in all this, which also played an important role in the adoption of such a thing as the national debt ceiling. This is politics.

Politics

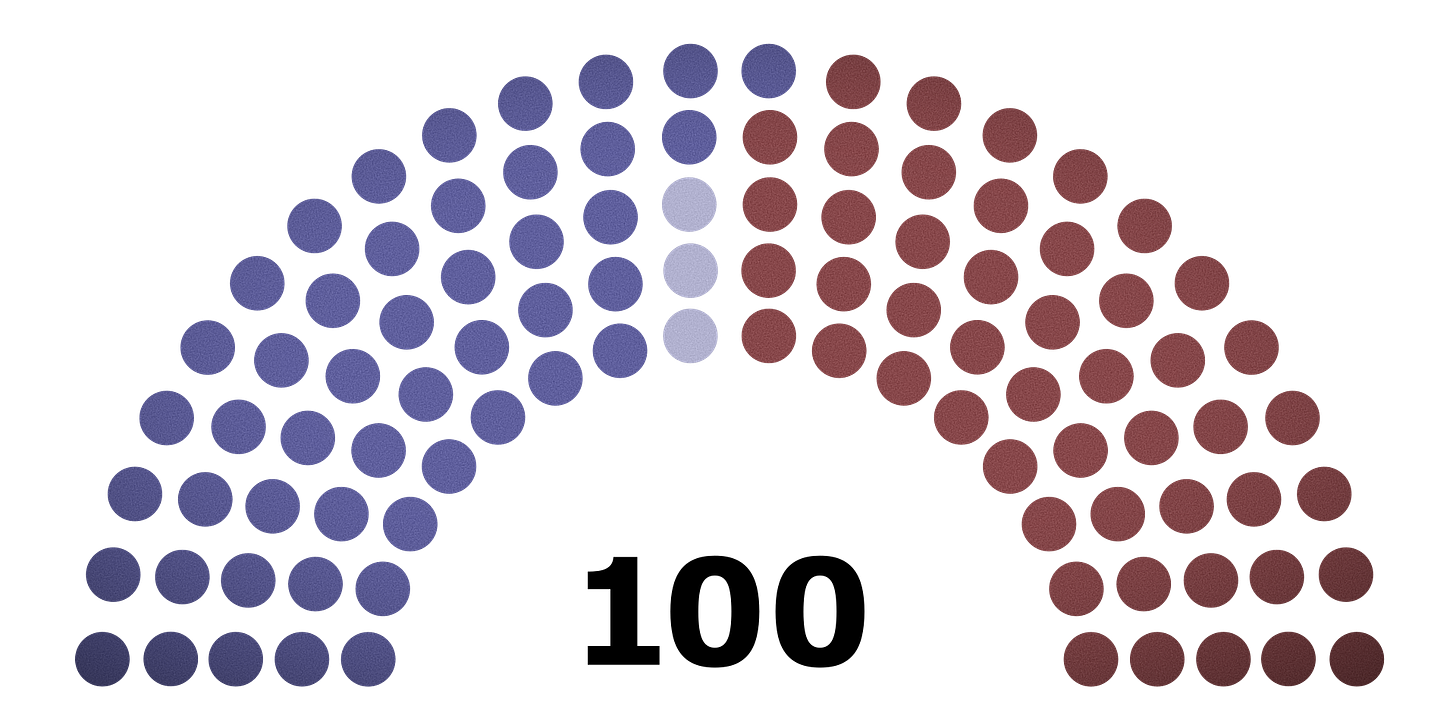

The issue of raising the national debt often becomes controversial and politically significant due to disputes and disagreements between political parties in the US, mostly essentially between Democrats and Republics.

The importance of this aspect is related to several factors:

The decision to raise the ceiling affects a country's fiscal policy, including the level of spending and taxation. Different political parties may have different approaches to fiscal policy and vision of the government's role in the economy, leading to disagreements about raising the debt ceiling. This is the first one.

What about resource allocation? Raising the debt ceiling could spark discussions about how and where to allocate federal funds. Different political parties and interest groups may have different priorities and preferences regarding the direction of budgetary funds, which affects the political debate on the issue of the public debt ceiling. This is the second one.

Last but not least. Different parties may also have different views on the role of government, the market economy, social programs, and even the role of the United States in the world. These ideological divisions may be reflected in the public debt ceiling debate and influence policy decisions in this area. Suffice it to recall the active political struggle between Biden and Trump in the previous presidential elections. This is the third one.

Historically, the issue of raising the debt ceiling has often been the subject of political games and agreements between parties. This is because party leaders use the issue as leverage to achieve their political goals and seek specific compromises and agreements in exchange for support for raising the ceiling (2011th, say hi). This can lead to tough and difficult political situations, especially when parties are in conflict or when the political climate is very tense.

Now ask yourself — what is the difference between all the written above and what happened all the spring of 2023? Before I give you an answer to this question, I will first dwell on the premises and then directly the causes themselves that initiated the recent crisis with the US national debt ceiling.

Background

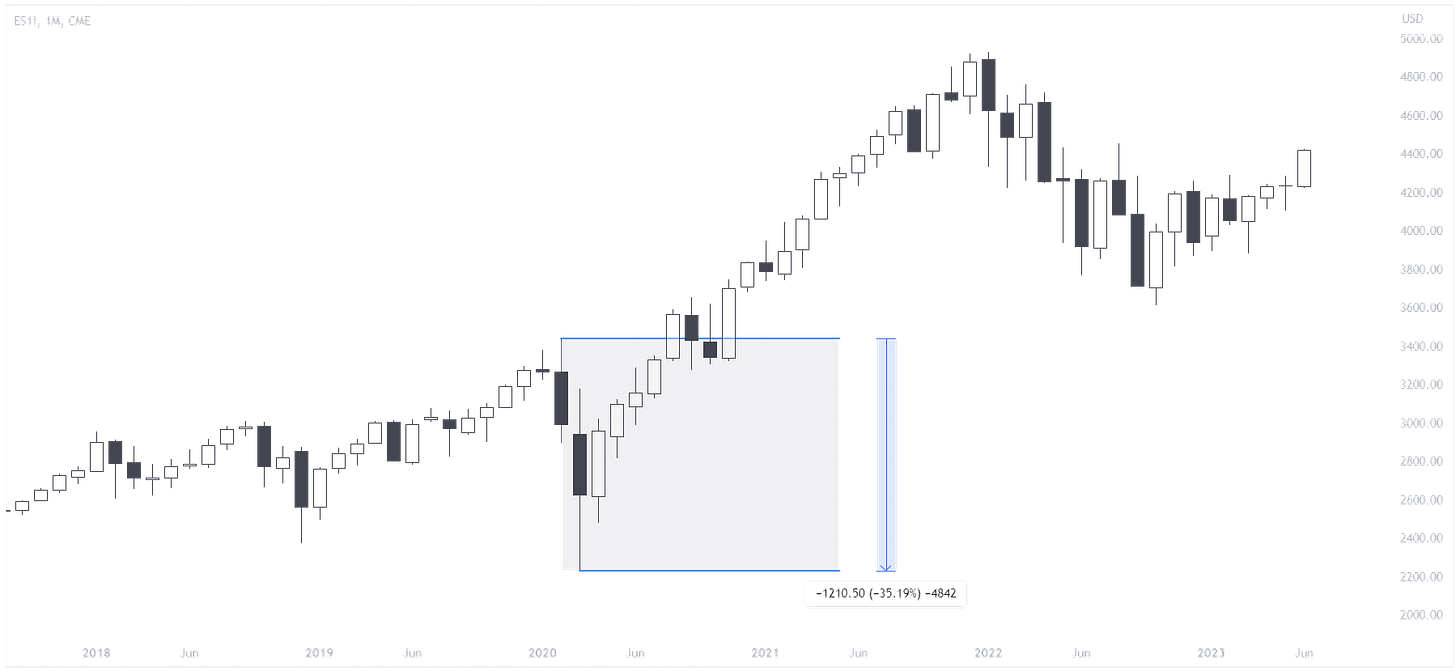

Let's go back to the seemingly distant 2020th. What comes to your mind first? Quarantine that rolls over countries in waves; a sharp rise in unemployment around the world; the collapse of stock markets and shares by ~ 30-50%; suspension of flights and a collapse in logistics? I assume that some of the above stuff is very likely to come to your mind when it comes to that period.

Let's go in order. What was the majority of the states of the world experiencing at that moment? A sharp increase in the unemployed, locked in their homes - benefits (cash) are needed. Systemically important enterprises that are suddenly on the verge of collapse need debt restructuring and subsidies (more cash). The health care system is experiencing, to put it mildly, not the most feasible stress test - government assistance and subsidies (even more cash) are needed.

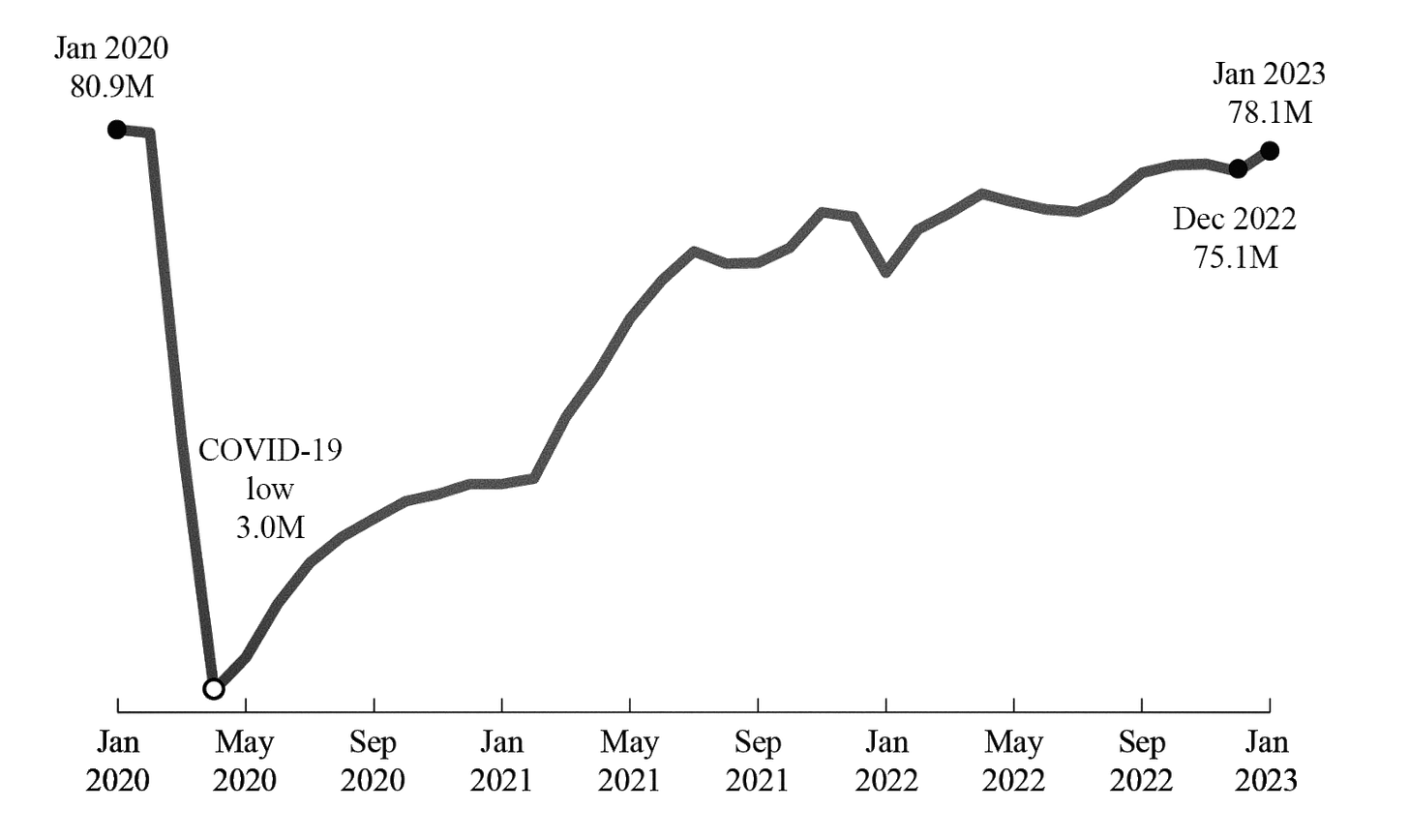

As you can see, the need to finance various areas of the economy has become the main task of the American (and not only) government, without exaggeration, becoming a vital role, it's fact. As a result, we received a very noticeable increase in the money supply (M2) in the economy, which could not pass without a trace for subsequent periods.

The logical question is: could this money just come from thin air? Forget this hackneyed story about “printing dollars as much as they want” and let me explain in a nutshell how it works (the reason for this is more than ever suitable).

We have already figured out - the state can borrow money in various ways, the most common of which is the issuance of government bonds. These bonds in the US are issued by the United States Department of the Treasury. You probably often heard these papers under such names as Treasuries, T-bills or Bonds. All of them belong to treasury securities, differing only in maturity.

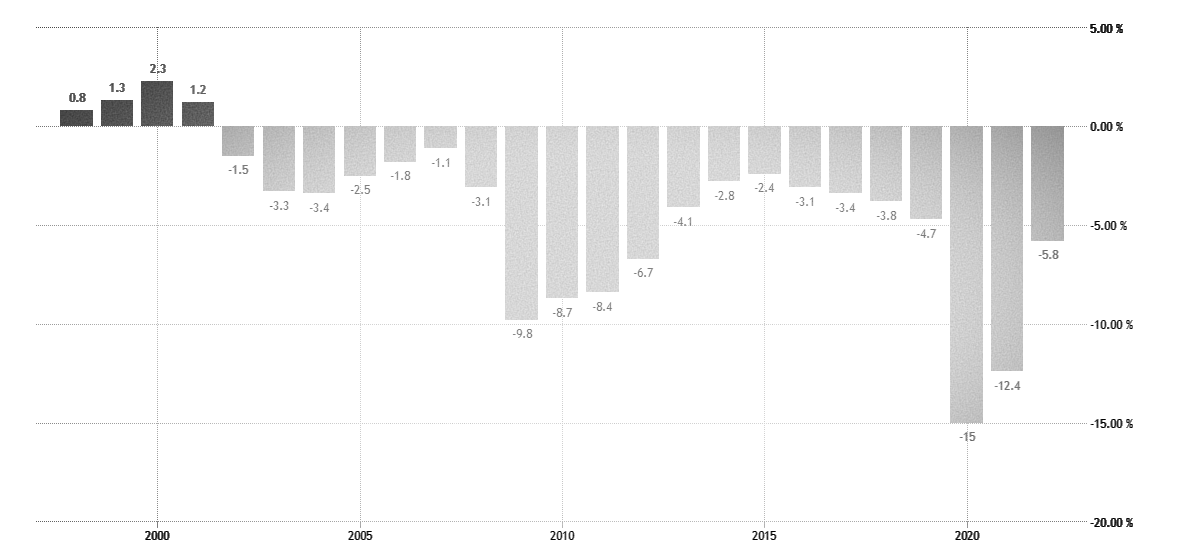

Since 2002, the United States budget has been in deficit, that is, spending (social projects, infrastructure, benefits, defence, etc.) exceeds revenues (taxes and fees, state-owned enterprises, etc.). Therefore, the US Government is forced to resort to covering this difference - the deficit - by attracting borrowed funds, under which they issue bonds (treasuries). In the modern economy, the functioning of the financial systems of most civilized countries of the world is arranged according to a similar principle.

In this regard, 2020 is no exception. The US government has adopted several massive fiscal stimulus packages to support the economy during the pandemic. As part of these measures, a significant increase in government spending was envisaged, which led to an increase in the volume of Treasuries issued to cover additional spending from the budget.

When I say “significant increase,” I mean the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act) passed in March 2020. Additional aid packages followed, such as the Consolidated Appropriations Act, 2021 (about $900 billion in stimulus) and the American Rescue Plan Act ($1.9 trillion in aid).

Add to this the funding for research into vaccine development, the purchase of medical equipment, protective equipment, and other indirect measures to support the economy and government programs - the total will be even more impressive.

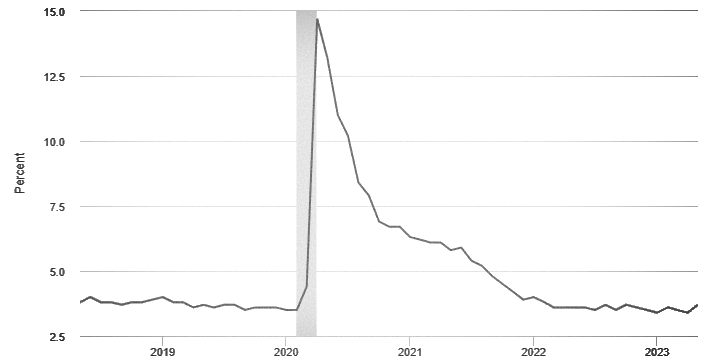

In addition, the US Federal Reserve System could not remain on the sidelines. Let me remind you that its main functions are to fulfil the duties of the US central bank, and maintain balance and stability of the financial system and the economy as a whole (including inflation and unemployment). Therefore, the Fed intervened in the situation dramatically deciding to reduce interest rates to almost zero and introducing a program of quantitative easing (Quantitative Easing).

What does this mean for the markets?

Everything is quite simple. Cheap money, that is, funds that could be borrowed at a more pleasant interest rate for the borrower. A significant part of all Treasury bonds is held by the Fed, which has been actively buying them since 2008 as part of the quantitative easing policy after the global financial crisis. The current COVID case was no exception.

That is, available (“helicopter”) money through the mechanism of issuing treasury bonds and financing state programs literally flooded the economy, saving it from the “black swan” (in the face of COVID-19). Keep this in mind and let's move on.

Now consider the participants on the other side of the economy - the consumers. During this period, the savings of the average American experienced growth. But really, being bottled up within four walls, protected from the previously familiar social benefits in the form of cafes, restaurants, concerts, movies and travel (in other words, ordinary leisure), what else can you spend money on? The economic activity of citizens experienced a decline.

Therefore, during quarantine and restrictions, many people reduced their expenses and began to accumulate savings more actively. This led to a subsequent increase in money in circulation and potentially contributed to the growth in demand for goods and services after the restrictions were lifted. And as we know, if supply fails to quickly adapt to growing demand, this can lead to higher prices and inflation.

Due to the same restrictions and closures during the quarantine, many consumers could not spend their money on various goods and services. After their removal from the economy, such a phenomenon as the realization of pent-up demand usually occurs. At this time, consumers seek to satisfy their accumulated needs, which leads to an increase in demand for certain goods and services, as well as higher prices and all the same inflation. The states were no exception, it is enough to recall the pace of restoration of air travel after the lockdown was cancelled.

And of course, restarting the economy. After the lifting of restrictions and the restoration of economic activity, the Fed continued to keep the rate at a near-zero level, thus stimulating a faster recovery of business activity in the country. The consequences of an increase in cash flows and turnover of funds were not long in coming, and since the beginning of 2021, there has been a noticeable increase in inflation in the country.

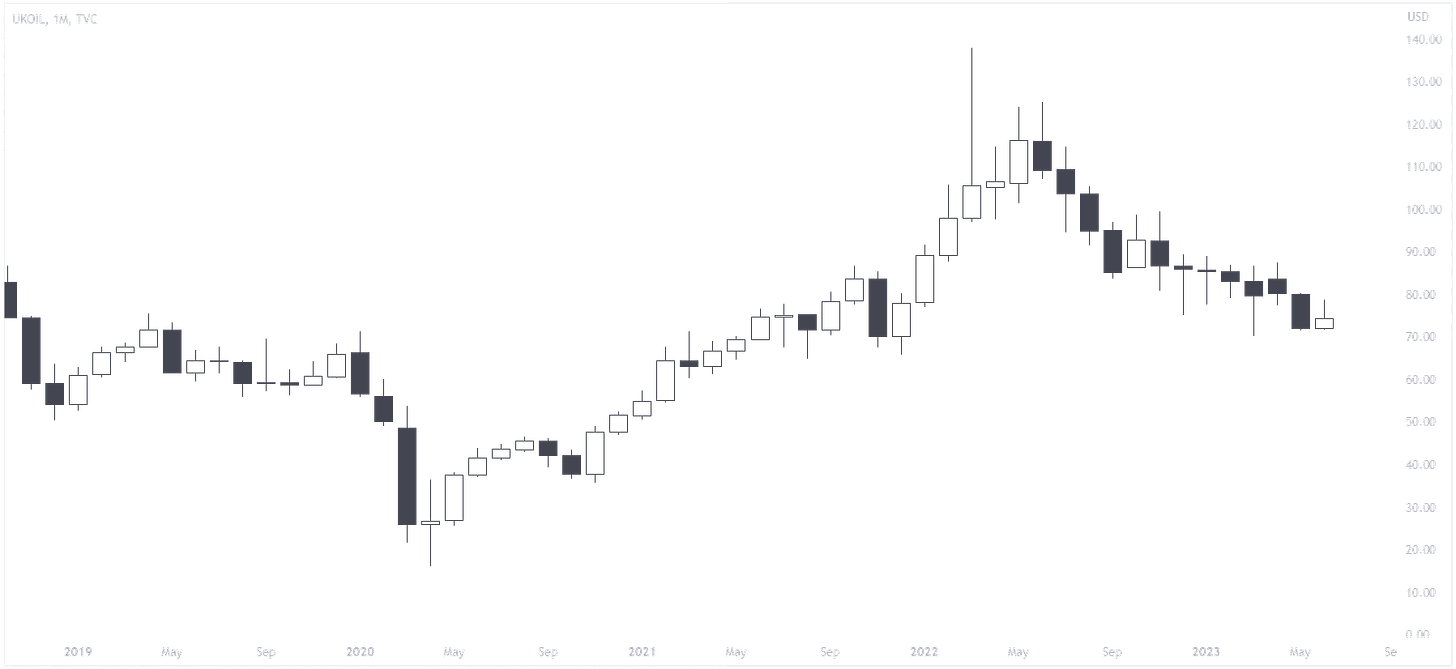

After the global crisis, the recovery of the world's leading economies spurred enterprises to increase the production of goods and services. It was like a domino effect pushing the commodities (commodities) charts up, where oil was in the spotlight.

What was the reaction of the authorities and regulators?

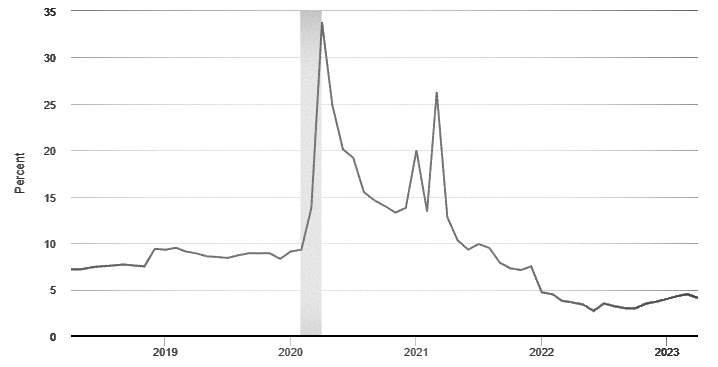

As we can see from the charts above, the Fed decided to act only at the beginning of 2022, when the price of oil had already doubled over the previous few quarters. The cost of energy resources is one of the key cost items in production, so every American has felt such changes in the end, without exaggeration. Whether it's an increase in the price of fuel, utility bills, or the cost of a grocery basket - inflation quickly emerged and has reached a value of 9%.

The energy crisis, which until then had been brewing in Europe for about a year, reached its climax in 2022 with the start of a full-scale war between Russia and Ukraine. Forced metamorphoses in the European energy sector have launched a chain of consequences for the entire market. Only in May, the price of oil began to weaken and lose its peak position. And yet, this was enough for the American economy that the Federal Reserve began to actively fight inflation by aggressively raising interest rates.

Why am I talking about all this in such detail and what does this have to do with the national debt ceiling? What do the coronavirus, cheap loans, oil, inflation and the Fed with its rate have to do with it?

As I said at the beginning, the issue of public debt is quite complex. And in order to understand where (and most importantly why) we will move on, we need to comprehend the cause-and-effect relationships that are behind the scenes of what is happening. All of the above events and processes forced the United States government to actively intervene in the affairs of its economy, first financially saving it from collapse, and then also financially stimulating the process of active recovery.

The days of cheap money are over, the interest rate has risen, and the very inflated amount of obligations in the form of paying interest on bonds has not disappeared. So we are smoothly approaching January 2023 - the moment that the American economy has been waiting for several years.

January 19, 2023

On that day, the Secretary of the Treasury of the United States of America went public with a statement announcing the following: The Treasury is taking emergency action to avoid default and continue to pay the bills of the federal government as the United States has reached its $31.4 trillion public debt limit.

Yellen said at the time that the Treasury would suspend new investments in the Public Service Pension and Disability Fund and the Postal Service Retiree Health Insurance Fund until June 5, 2023. Under the circumstances, this decision was taken with the aim of continuing to meet its obligations on time until the public debt ceiling is raised.

And here our attention comes to the Treasury General Account (TGA). You may have already heard something about him. This is the main US government bank account at the Federal Reserve Bank, managed by the Treasury Department (aka Treasury), which holds funds from the US federal government. These include receipts from tax revenues, borrowings, sales of bonds, and other sources of government funding. The TGA account is generally used to manage government spending, pay government obligations, and maintain the government's daily balance sheet.

The work of the TGA account is carried out in close cooperation between the US Department of the Treasury and the Federal Reserve Bank. When the US government needs funding for its expenses, it can request a transfer of funds from the TGA account to other accounts to cover its obligations. As deficits accumulate or government spending increases, the balance of the TGA account may shrink and the government may be forced to raise additional funding or increase public debt.

In addition to the Treasury General Account, the US Department of the Treasury also manages other funds on a daily basis and uses various sources to fund its operations. These may include primarily borrowing through the issuance of government bonds, tax revenues, Fed profits, and other sources. That is why, when the opportunity to attract new loans became unavailable, and spring tax revenue did not live up to expectations, Yellen was forced to turn to "emergency measures." That is, confidently flush the cache from TGA. Looks like it's sorted out here.

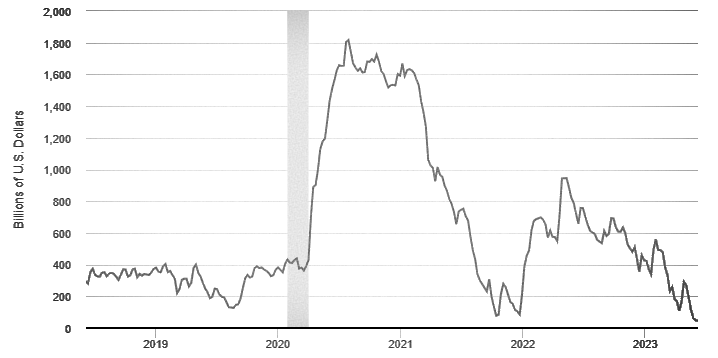

Now directly about money. As a general rule, the Treasury aims to keep the balance in the range of $500-600 billion to provide a sufficient buffer for situations like this discussed in this article. As the Treasury took "extraordinary measures" to avoid exceeding the debt ceiling, the balance sheet shrunk to just $49 billion in May of this year.

The drop in the balance sheet actually added liquidity to the markets at the same time that the Federal Reserve provided additional liquidity after the collapse of Silicon Valley Bank (“SVB”) and several other regional banks.

X-Date

The devastation of the Treasury General Account (TGA) and the lack of compromise among the authorities added fuel to the fire. Yellen wasn't exactly sure when to expect this "X-Date", vaguely referring to early June as the ultimate deadline. The media began to appear and increasingly hear phrases about the inevitable default and a new global financial crisis. However, on nothing else but pseudo-arguments and emotions, such serious statements were no longer built.

No, I completely agree with you if you say that the American economy is far from ideal, it's neither in balance nor in good shape. There is no doubt about this. But according to quite objective factors, it was at least irrational to expect a default of the world's largest economy, under the financial system of which the rest of the world is tied up.

In order not to be unfounded, in fairness I’ll say that back on May 24, for our community, I hosted a stream on Discord, where for more than an hour I analyzed the issue of the United States government debt, including the reasons why a default would not occur. With your permission, I will summarize them below.

Historical parallels. Since 1997, the government debt ceiling has been revised 22 (!) times. Moreover, this was done three times under Trump, during whose presidency the country's obligations increased by as much as 8 (!) trillion dollars. This kind of friction between representatives of parties has already taken place in history and there is no need to go far. In 2011, there was a similar situation, but the Obama administration eventually also found a compromise. The default did not happen.

State of affairs in the world. The United States, without exaggeration, occupies a leading position in the global economic arena, and the country's government securities are considered one of the most reliable assets for investment. Will the government of a country that decides to default shoot in the foot not only itself but also all other countries holding dollars and treasuries in their reserves? But God bless them with those other countries. In this case, the stock market, as a haven for free foreign exchange earnings of foreigners, will be waiting for an unprecedented outflow of funds. Who needs it, even before the elections?

2024 presidential elections. For a representative of the Democrats and the incumbent President Biden, who has already expressed a desire to be re-elected for a second term, and for McCarthy (Speaker of the House of Representatives) representing the Republicans in these debates, the lack of compromise and the failure of the public debt deal would certainly not add points to the upcoming election campaign to these guys and political parties they represent.

Confrontation with China. I think it's important to put this argument in a separate paragraph. So far, things have not come to any military clashes, the main reason for which is Taiwan. However, to deny the tension between the countries and the remote semblance of the formation of geopolitical blocs is at least stupid. In this race, there is no option for the States to sit in a puddle and give the opponent all the cards in hand while calling into question their financial (and political) stability for their closest partners.

Resolution

And now the thing that surprises me the most (no). The epic is over. The deal is signed. Everyone can breathe a sigh of relief. But is it so?

It is important to note that for financial markets, the story at least does not end there. After weeks of negotiations, Biden and McCartney agreed in their final decision to cut federal spending by $1.5 trillion over the next 10 years. The focus of the government will leave only the main social programs.

At the same time, the debt ceiling was not raised. Its action was suspended altogether. The deadline is January 1, 2025, right at the start of a new president's term.

Going further. Why TGA?

Everything that I wrote above allowed us to understand the logic of this crisis and the reasons behind it. Now, let's apply the knowledge and information we have gained to reasonably predict the possible future paths for the development of the United States financial system and understand what impact this will have on the markets.

No wonder I paid so much attention to TGA. Depleted cash reserves need to be replenished and done quickly, at least for the adequate functioning of the daily activities of the Treasury. Market participants disagree on the extent to which the balance will be restored. But restoring the TGA's healthy balance sheet will require $750 billion to $1 trillion in Treasury issuance over the next three to four months, according to most analysts. Not bad, right? And now let's take a look at the fingers, how and by what logic it will work.

To simplify as much as possible, under normal conditions, there are several entities that are directly or indirectly affected by the issue of Treasury securities. This is directly the Treasury itself, the Fed, commercial banks, as well as enterprises and households. How is the interaction between them?

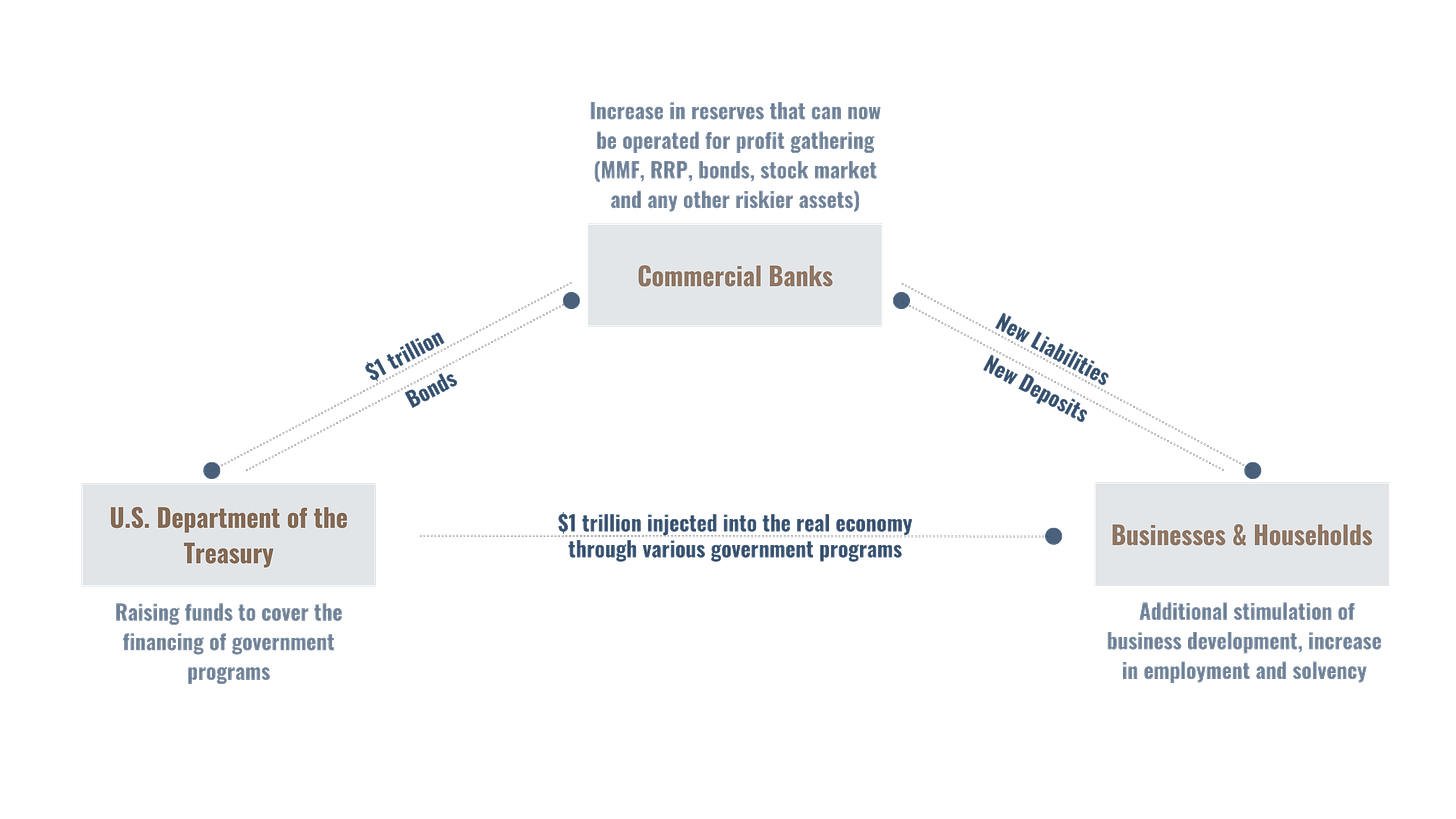

Let's imagine that the authorities of the United States need to raise funds for a newly developed government program (and if the market has already formed an opinion about raising $ 1 trillion, then for simplicity, let's operate with this amount in our imaginary example). This state program can relate to improving the standard of living of citizens through both direct and indirect cash injections. For example, not unemployment benefits, but subsidies to enterprises to create new jobs. Regardless of the method (direct or indirect), the economic benefits in the form of financing will be distributed among households and enterprises and will eventually enter the real economy, bringing the positive effect originally intended.

Due to the possible lack of free funds (let me remind you that the US state budget is in deficit), the Treasury enters the bond market with the issue of securities. If we really simplify, then treasuries in the amount of 1 trillion go to investors, and their funds form a pool for further financing of our conditional state program.

As a result, this injection of 1 trillion dollars will in the end fall into the bank accounts of Americans and their enterprises in the form of various kinds of deposits. For banks, this means:

as an increase in liabilities (+$1 trillion, which will need to be returned to depositors, and even with interest);

as well as an increase in reserves, which can now be operated for profit (MMF, RRP, including investing in Treasuries).

In short, in the example above, bank reserves are not reduced when the government issues bonds to finance deficit spending.

Nothing suspicious seems to be happening, right?

Yep. But now we are faced with a situation where small adjustments to this scheme radically change the whole essence of what is happening. Now it will look like this. As they say, watch your hands.

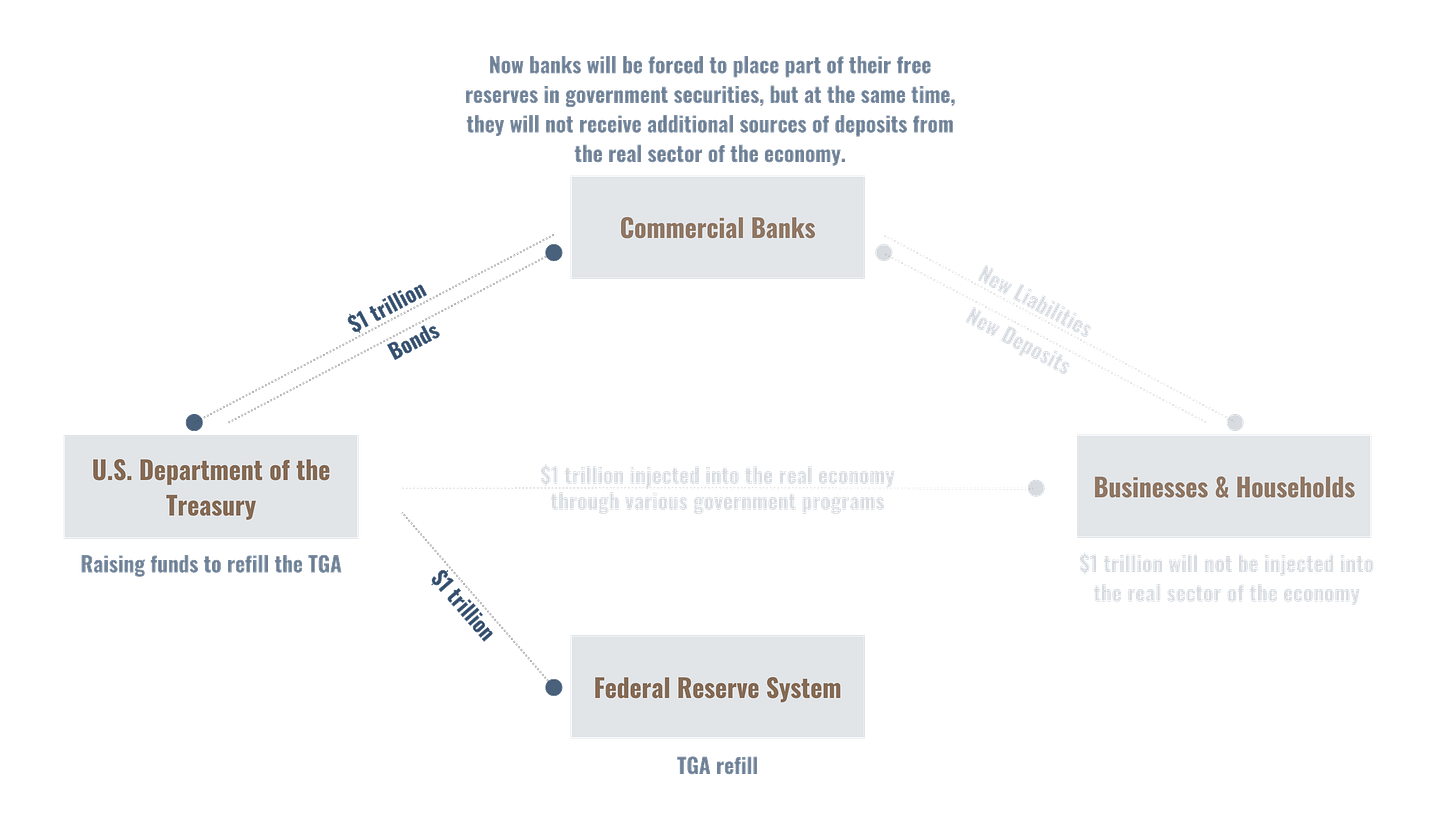

First, the Treasury will need to issue bonds to replenish its account balance in order to maintain a sound level of operating activity. We see the first inconsistency - money in the amount of our conditional $1 trillion will not be spread among the subjects of the real sector of the economy.

Secondly, nothing will contribute to the growth of banks' liabilities, since they do not receive any additional sources of deposits from the real sector of the economy. But everything is the same with assets, and banks will now be forced to place part of the free reserves in government securities.

This is how the TGA balance will be restored, which in narrow circles of financiers is referred to as liquidity drain, that is, a reduction in liquidity. The entire blow falls on bank reserves.

You could immediately ask two questions: why are banks' reserves considered liquid and why will they be forced to go into freshly printed treasury bonds? Well, let me answer.

Liquidity

Banks' reserves are primarily part of banks' high-quality liquid assets (HQLA). The larger the volume of these reserves, the more diversified the bank's asset portfolio will be. I mean that significant amounts of reserves allow the bank to increase its presence in the market of riskier assets. These include the stock market (stocks, stock indices, etc.), commodities, as well as the real sectors of the economy (real estate is important here). Sometimes it comes to the crypto industry, in the vast majority of cases indirectly.

The presence of banks in these markets in the form of providing liquidity sets the tone for the entire market game. In such cases, competition among participants in the banking system favourably affects the conditions for borrowers, as well as spreads, if we are talking about the stock and bond market.

Now imagine an equally opposite situation - bank reserves are declining. In this case, the defensive position that the banks will take is quite obvious. Each new potential deal will be more carefully weighed and analyzed, avoiding unnecessary risks and prioritizing stability and work at a distance instead of momentary profit. Definitely a conservative approach.

Why Treasuries?

Everything looks logical until we run into the question “Who will buy these bonds and who actually needs them?”.

The fact is that the bulk of the missing balance will be realized through the issuance of bonds in the next 3-4 weeks, and in general it will have to be completed by September 30th. It is then that the fiscal year ends in the United States, and by that time many budgets of various levels (from municipal to federal) will be approved. When entering the bond market in order to raise funds, the Treasury will rely on the current yield levels of bonds traded on the market. This means that the coupon (cash payment to bondholders) will cover the existing risks.

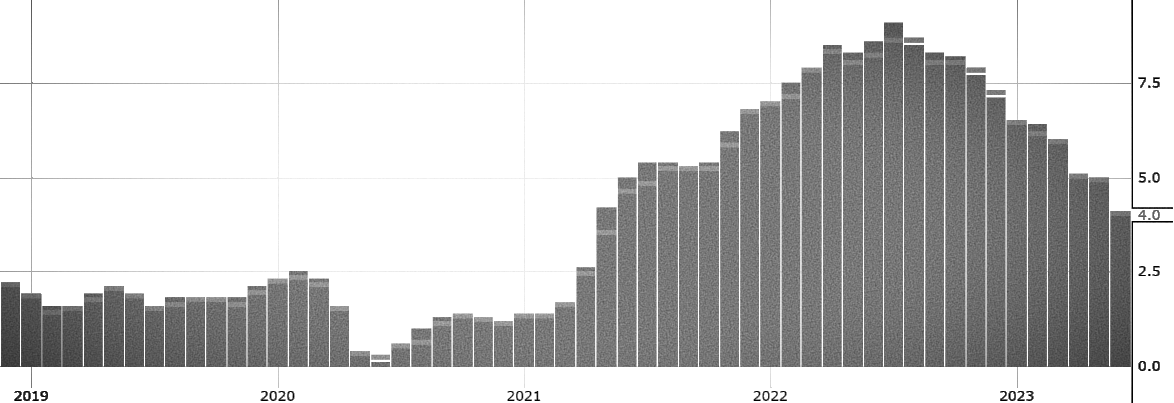

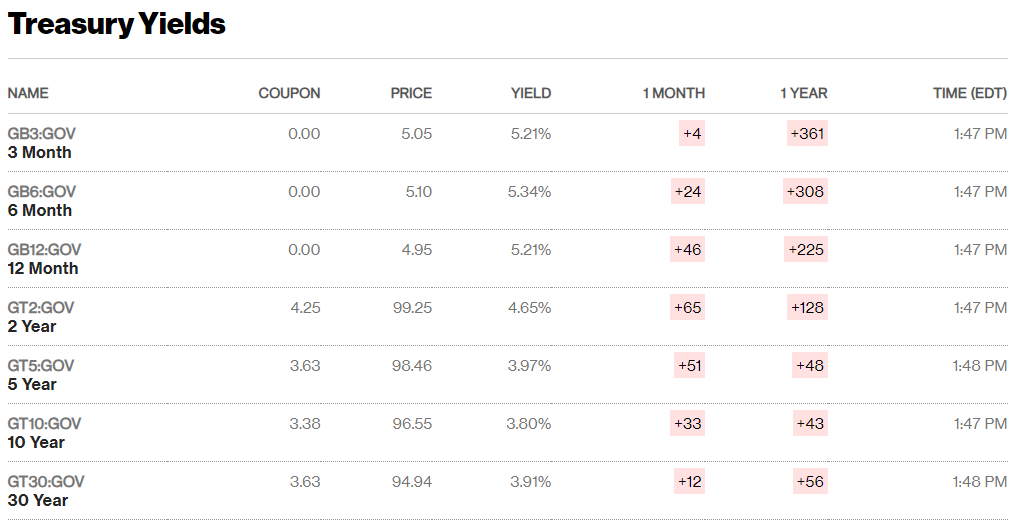

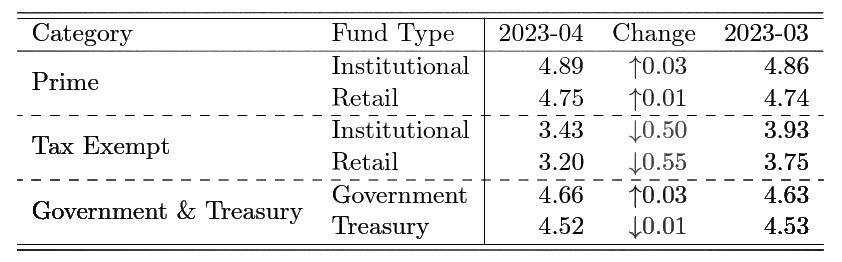

The condition of the government bond market at the time of writing is as follows:

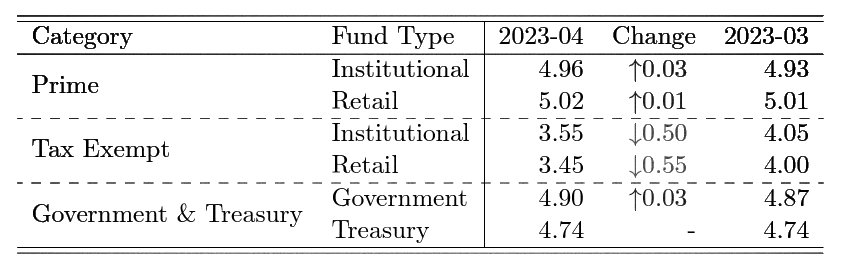

Since banks have not been able to place their free reserves in reliable government bonds since January 2023, their presence has increased on Money Market Funds, RRP and, of course, more risky assets such as stocks, indices and even cryptocurrencies, which since the beginning of the year have thus quite logically experienced moderate growth.

Now the Treasury supplies the market with a huge volume of securities. Already the other day (at the time of this writing - starting from June 13, 2023), the sale of bonds for at least $166 billion is expected.

And now a question for you. If you were in the place of banks or institutional investors, in the current turbulent economic environment, would it be more profitable for you to open positions on risky assets or enter risk-free ones, that are also with a high guaranteed return? I think this is a rhetorical question.

Moreover, in support of this thesis, many other factors should be attributed. From the bond yield graph above, it is quite clear that the yield of short-term bonds exceeds similar values for long-term government securities. That is, we have an inverted yield curve - one of the indicators indicating at least a disorder in the economy (historically, this signalled an imminent recession).

Also, the economic context described above, to which I devoted a large portion of this article, now clearly allows you to evaluate the logic behind the upcoming liquidity drain. The Fed's policy of quantitative tightening, the rapid increase in the discount rate, the overheated labour market and the desire to raise the unemployment rate to the target (ideally up to 5%) are not at all conducive to investing in risky assets.

I think it is not worth explaining how all these measures aimed at reducing risks and ensuring the financial stability of banks during the current uncertainty and economic instability can affect the stock market, currency and cryptocurrency markets.

“Sell in May and go away” and classic summer in the markets are here.

Thanks for your attention!