[EN] CLS IS (NOT) AN ALGO

Based on the analysis and fact-checking, the false beliefs about the alleged existence of a single universal algorithm that manipulates price values in the currency and stock markets are analyzed.

Perhaps, since December 2022, when scrolling through the Twitter feed, I increasingly began to come across references to a certain algorithm that controls the forex market, manipulates quotes and mercilessly knocks out traders by stop-loss orders. Phrases like “Price movements are predetermined at the beginning of the day!”, “Only a big player who manipulates his algorithm earns!”, “The algorithm will soon change and the market will start working differently!” were widespread among both Western traders and representatives of the Eastern European community.

Naturally, no one published any confirmation or at least some primary sources of the origin of such information, and the “degree of seriousness” of the statement was in direct proportion to the confidence and pathos of the tweet of another opinion leader. It would be worth it to smile and immediately forget about it, however, from the members of our community (salute to Mirror Reflection✋🏻), from time to time I received questions regarding the operation of "an algorithm" and requests to share my thoughts on this matter.

Now this story of mass distortion of information and playing on the newly emerging market participants has suddenly begun to gain momentum again, supported by the thesis of an upcoming change in "the algorithm". It is not surprising, because at the initial stages of developing themselves in this craft, many, due to our human nature, keep the hope of finding some kind of holy grail, instead of giving preference to diligent daily development and work on themselves.

From everywhere now they are trying to sell stories about market makers, for some unknown reason, mistakenly meaning by this almost every first fund, bank, broker or insurance company that comes across. And all these hackneyed phrases about “footprints of a big player”, which should have caused only a smile, instead now cause only bewilderment from ignorance that fills the information space.

Now it's time to change it.

In this article, you will find out whether that "algorithm" truly exists and whether it will experience changes; why traders focus on CLS but diligently overlook DTCC; why IPDA is not related to market making and whether it exists at all; and, what is most interesting, you will understand in detail whether this knowledge can really be used in a daily trading routine.

Intro

Hi everyone!

For those who read me for the first time, let me introduce myself. My name is Ruslan and on this platform, I set myself the goals of shedding light on the controversial issues that I encounter in my daily activities in the financial markets and which require deep analysis and close attention to details. An initial request from my colleagues at Mirror Reflection (and our audience) to clarify the situation with “algorithms” (CLS in particular) has grown from a couple of notes into full-fledged material, which you are reading now.

Due to my academic background, previous experience in Big4 and analytics positions in fintech startups, I base everything below on primary source checking, evaluating cause and effect relationships, pragmatic calculations, and most importantly, critical thinking. At the same time, due to the specifics of the topic, I will try to avoid using intricate economic definitions that may be incomprehensible to a wide range of readers. If I still have to mention them, then I will give detailed examples so that you do not miss any details.

So, let's work get started.

CLS

For the past 5-6 years the concept of Smart Money has become increasingly popular among the participants in the currency and stock markets. The formation of a trading strategy is supposed to be based on the logic of the movement of large capital between major market participants, which is reflected in a change in the market structure, the emergence of price inefficiency and other features that arise during periods of increased volatility (during trading sessions). I'm sure you're already familiar with this stuff.

Undoubtedly, ICT was one of the first to publicly begin to explain the logic of the financial markets as opposed to the established classical technical analysis. In this context, it doesn’t matter how you feel about Michael and his views on the market, but it will be no secret to any of you that among his followers, many decided to reinvent the wheel. Replace the terminology is the only bother they do for further hype around their “new” concepts and subsequent monetization. And when even that was not enough to keep the attention of the audience, they resorted to secret theories about algorithms that so far achieve their goal, creating hype and collecting likes on social networks.

In this matter of “algorithm”, insufficiently informed (or consciously dishonest) traders and opinion leaders took their look at CLS. But is CLS the algorithm responsible for manipulating price action in the FX market? And is CLS at least some kind of algorithm?

Spoiler: The answer to both of these questions is no.

If you are an ardent fan of the “CLS algorithm”, then I advise you to stop and not continue reading this material further, because the facts and logical conclusions below can hurt you.

What is CLS really responsible for and why should we delve into this topic?

Well, it is worth starting with the history of the development of financial markets and the foreign exchange market in particular.

CLS, as a clearing and settlement system that transacts in foreign currencies (including the euro, the US dollar, the Japanese yen and 15 other currencies), was created as a response to existing risks associated with transaction failures, primarily the Gerstat risk. I admit that you could already meet this information about the work of CLS in the frequently cited material from 2003(!).

To understand the Gerstatt risk, which is eliminated thanks to CLS, let's analyze the situation using an example. Let's imagine that you live in Berlin in the mid-1970s. You are a top representative of a large commercial bank that plays on the growth of the US dollar against the German mark. And then Friday comes, it is almost the end of the banking working day in Germany when suddenly you receive a notification from the regulator about depriving your bank of a license. Why? As a result of fluctuations in oil prices, the position of the dollar against the mark sank. You suffered losses that you previously tried to hide, but the authorities nevertheless revealed these violations. Okay, things happen.

But at the same time, on the other side of the Atlantic, the working day for banks has just begun. At least 12 banks have already managed to send a significant amount of German marks to your bank accounts (about 200 million dollars at that time). Due to a time delay, they did not receive their US dollar payments in return. And your bank is already gone. Well, something similar happened in 1974, following a chain of events that brought down the turnover of the trading system in New York by 60% in the following days.

This and other similar stories (you can find a more detailed description on page 33) pushed the representatives of the global financial community to look for more reliable ways of settlement, so on September 9, 2002, the decision to create the Continuous Linked Settlement (CLS) was issued. From now on, it began to act for international settlements, being directly responsible for the clearing of transactions and the actual settlements of payments themselves.

Clearing & settlement are post-trade processes for fulfilling contractual obligations for securities or foreign exchange payments. Clearing refers to the process of transmitting, negotiating and, in some cases, confirming payment orders or collateral transfer instructions prior to settlement. This may also include offsetting instructions, establishing final settlement positions, and changing contractual obligations. The settlement is the actual fulfilment of the obligations of the buyer and seller by transferring cash and/or securities.

It is important to understand that the functionality of CLS is limited only by those functions listed above and is in no way responsible for the rate at which currencies are exchanged between counterparties. The terms of the transaction are formed outside of CLS, and the system acts only as a guarantor for carrying out cross-border currency transactions on the PVP principle - payment-vs-payment - when settlement in one currency is carried out only if the settlement in the second currency is simultaneously settled. This mechanism almost completely eliminates the risks of losing the principal amount of the transaction, which we have modelled above.

Then what draws attention to the CLS from the traders' side?

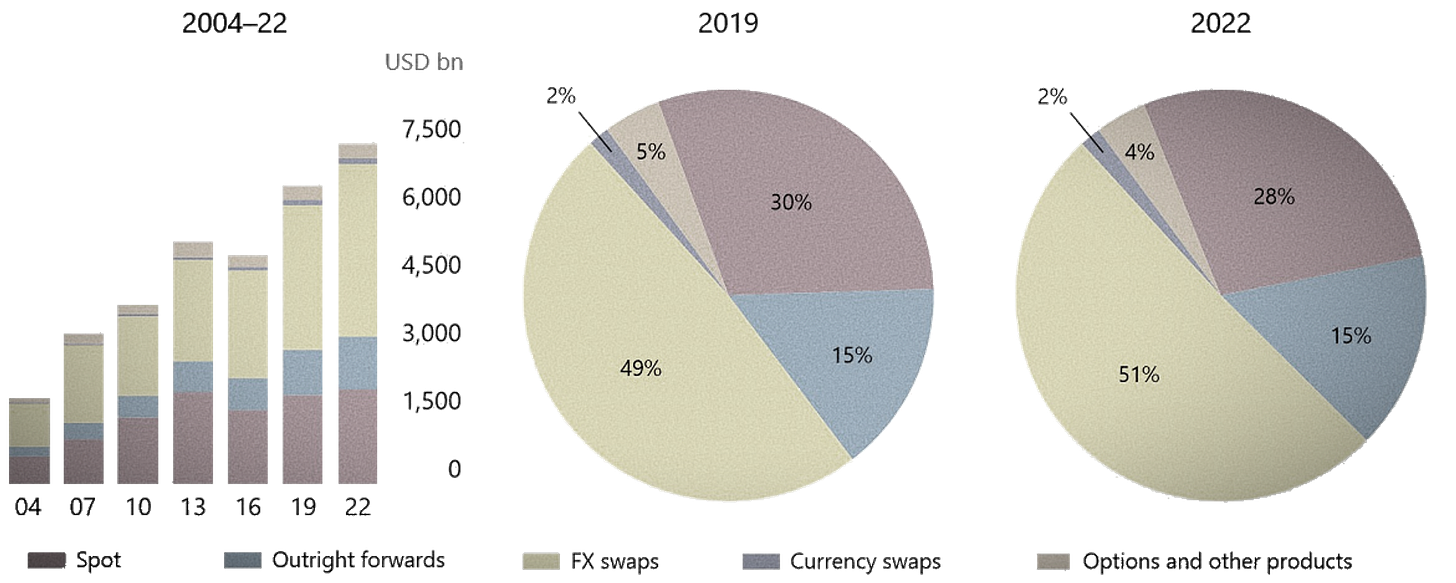

First of all, it is about the daily volume of transactions passing through the system (and its subproducts), which averaged about $1.8 trillion in 2022. CLS reported swap volumes of $1.18 trillion in December 2022, up from $409 billion for spot and $107 billion for forward contracts. Undoubtedly, against the overall average daily volume of the currency exchange market for 2022, which is ~ $ 7.5 trillion, the amounts processed by CLS look impressive.

As you can see from the infographic below, the structure of the FX market is noticeably segmented and, in addition to spot currencies, is also represented by swaps, forward contracts, options and other derivatives. Why do you need to pay attention to it?

The fact is that the foreign exchange market is closely integrated into the global financial system. And first of all, it is connected with the securities market. Stocks and bonds traded on stock exchanges, under the influence of various macro- and microeconomic factors, stimulate the circulation of currencies that act directly as liquidity for various market participants and as a risk-hedging tool.

Therefore, it is important to consider when and how this liquidity begins its redistribution. In this context, it is worth considering the time window of the Continuous Linked Settlement and RTGS (Real-time gross settlement) systems. The last ones are national (or regional, as in the case of the euro) funds transfer systems in which money or securities move from one participant bank to another on a 'real time' and 'gross' basis. For the United States, these are, for example, Fedwire and CHIPS, for Europe it is TARGET2, in Britain it is CHAPS, etc.

These systems, due to historical, geographical, technical and other features, have different times of active functioning and sometimes do not even intersect with each other. Singapore and Argentina, due to their location on opposite sides of the globe, are a great example.

For this reason, actual settlement processing occurs within a five-hour window when all relevant RTGS systems of CLS member countries are open to send and receive funds. For Asia-Pacific currencies, the window is limited to only four hours. During this time, matched transactions are selected and passed risk management tests one at a time. After passing them, the settlement becomes irrevocable and is carried out immediately and irrevocably by posting debits and credits to the accounts of the settlement participant in the CLS books.

To settle a foreign exchange transaction through CLS, both parties must submit their instructions no later than 00:00 CET via a SWIFT message. As soon as they are received, the instructions of both participants are checked, authenticated and compared.

Starting from 07:00 CET, the orders are settled sequentially by irrevocably debiting the sub-account of the sold currency and simultaneously irrevocably crediting the sub-account of the purchased currency. This continues until 12:00 CET. After that, the cycle restarts.

The operation of the cycle is clearly described in the official video:

All of the above gives us an understanding that CLS only provides for currency exchange operations between counterparties, but in no way affects the formation of this rate itself. However, there is also an opinion that during this time period, due to the release of liquidity, the main trading volumes for the day occur, and allegedly this is the main factor in the increased volatility in the London session. But is it really so?

To understand this, I suggest turning to the Markethours, which aggregates information on trading volumes and displays it in the form of an interactive infographic that is easy to analyze. As we can see, at 7:00 CET there is only a slight increase in the volume of currency trading. And this is despite the fact that T2, one of the TARGET (European RTGS) services, also launches at 7 am CET to meet the needs of the financial market in general and its European customers in particular. A more noticeable increase in volumes still occurs with the opening of the Frankfurt Stock Exchange, while the peak of the first half of the day falls on the opening of the London trading session.

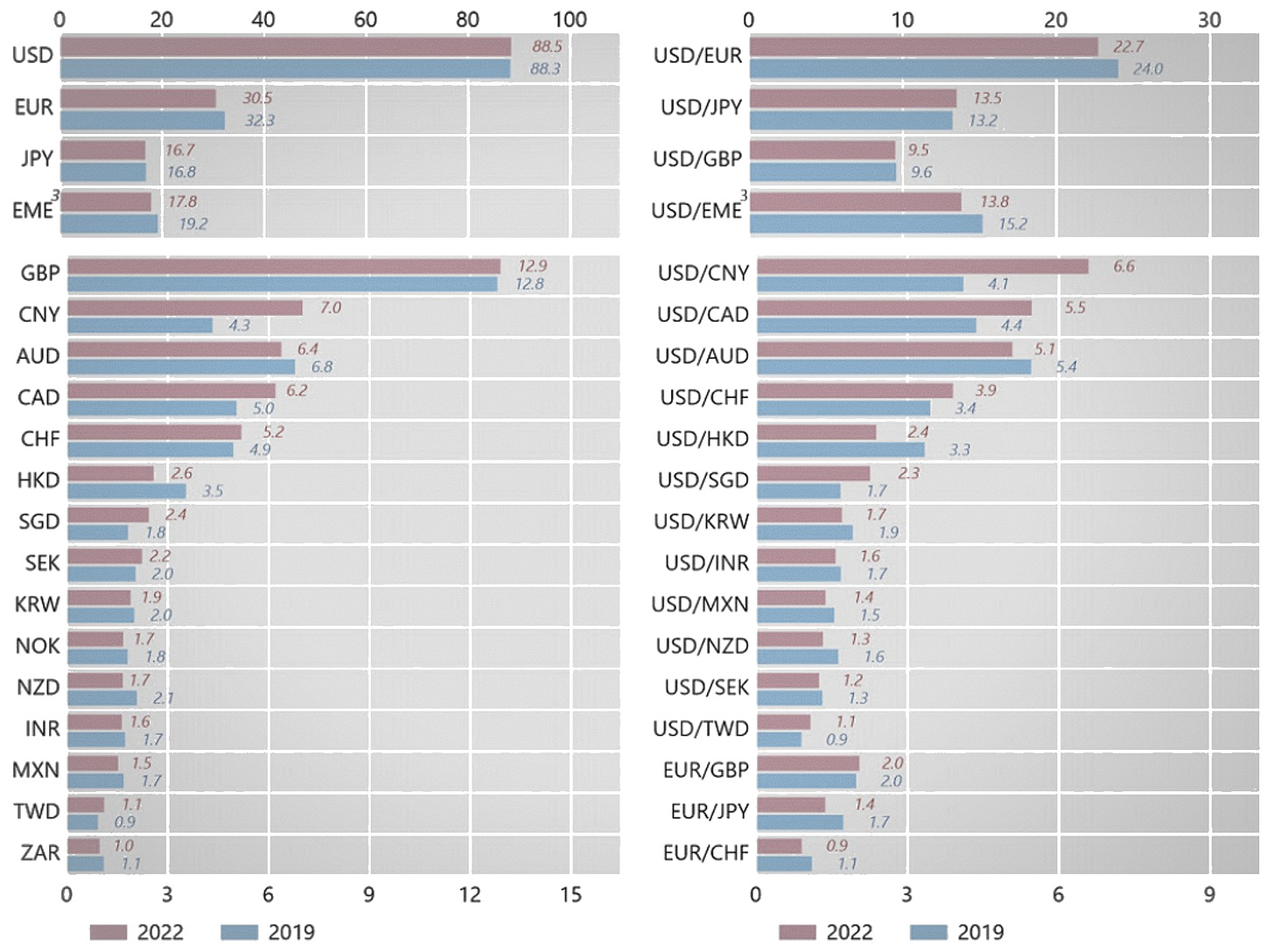

It is not surprising, because the currencies of developing countries (which are mainly represented by the countries of the Asia-Pacific region) occupy no more than a fifth of the total volume of exchange, which is also due to the level of economic activity of those participants.

But as I mentioned above, in addition to speculative interest, the currency acts as liquidity for stock markets and real sectors of the economy, as well as a risk-hedging tool. How about considering this side of the issue in more detail?

DTCC

In the context of all the talks about the “algorithm”, you have probably heard phrases like everything will change soon, the algorithm will change the behaviour of the price in the market, or in general it should stop working. To be precise, some updates really do take place soon. But not with the “algorithm”.

Now when trading securities, settlement usually takes place two days after the trade, which is a widespread practice, abbreviated as "T + 2". I'm sure you may have met it before. If you dive into history, then in the old days, when assets had to be physically delivered by a courier “on horseback”, a quite typical settlement period was T + 14. In the period from the 1970s to the 1990s, the settlement cycle was reduced to 7, 5, and then to 3 days. Then, T + 2 became commonplace for securities in 2014 for the EU and only in 2017 for the USA, as back office processes gradually required less time-consuming manual intervention and were automated.

As the world becomes more digitalized and rapidly changing, the transition to the T+1 settlement cycle is just around the corner in the securities market. So, in January 2023, India completed the transition to T + 1, and the US and Canada will do the same for most securities transactions starting in May 2024. The EU and the UK have not yet decided on their approach and for the time being most of their local financial markets remain operating under the T+2 settlement cycle.

It should be clear right away that we are not talking about CLS. In this case, the acceleration of the time of the same clearing & settlement processes is expected, but for the securities market, for which The Depository Trust & Clearing Corporation (DTCC) is responsible. Ultimately, the evolution of shorter securities settlement cycles has been driven by the practical limitations of what is technically feasible and operationally desirable.

The evolution of the settlement cycle in FX quite coincides with the evolution of the securities settlement cycle, but it was due more to a voluntary agreement of market participants than to any strict rule. If two market participants want to exchange currency on the same day or even at the same time and do not follow the T + 2 rule, they are free to do so. Thankfully, there are plenty of ways to do this.

Most importantly, the settlement cycle should not be confused with the actual settlement, which occurs only at the end of the cycle. In the T+2 format, the currency trade is agreed on the “T” day and then matched and queued up to two days later, when settlement takes place within the 5-hour CLS window to fund the transactions.

Is not it because of the transition from T + 2 to T + 1 for the securities market in the circle of traders that all the hype that you could observe arose? The question is rhetorical. Similar transformations for the FX market are not yet considered by regulators. Moreover, due to technological development and automation of operational processes, it would be logical to immediately switch to the so-called Atomic settlement, which Dirk Bullmann, CLS Global Head of Public Policy, wrote about in his article just a month ago (in July 2023).

According to him, instant settlement of transactions is already feasible today. The fact that FX is currently heavily based on the T+2 market standard, whereby settlement occurs two days after a forex trade is made, is not a technical limitation. It is more of an unspoken agreement reached in a complex post-trade ecosystem with many interdependencies between market participants and their internal processes.

There is a clear trend towards an increase in the speed of providing financial services. Same-day settlement and eventually even instant settlement (T+0) can be a logical endpoint for the FX market capability. In fact, due to differences in time zones, the transition from T+2 to T+1 for securities settlement may already require the currencies required for the respective cash delivery to be traded and settled under the T+0 format. This will certainly require a reorganization of back-office operations and create organizational challenges (listed in the infographic above, more details here).

But is it possible for these changes to influence the formation of market structure and work with price inefficiencies, which we see daily on the chart? Let's look at the situation with examples. Looking through the chart of the S&P500 index for 2016, several “book” situations that correspond to the Smart Money concept literally immediately caught my eye. Let me remind you that in 2016 clearing & settlement procedures on the US stock market were carried out within the T + 3 format.

All of these potential trades are displayed on the m5 timeframe for the S&P500 during the second half of March 2016. There are many such examples. Why don't we see any difference between the charts for 2016 and what is happening now? A little more of your time, fellows, because it's worth going through another common misconception.

IPDA

In addition to CLS, which is falsely referred to as an algorithm on Twitter, you may also come across such a term as Interbank Price Delivery Algorithm (IPDA). If you try to search for more details on the web, you will stumble upon Tik-Tok videos, recent Instagram posts by traders, and websites selling courses that explain the “algorithm”.

I did not find any material from an official source (central banks or officials close to them, financial market regulators or banking associations etc.). As well as I did not find information on this topic in academic databases, in which, by the way, there are plenty of articles and studies about Continuous Linked Settlement. All these stories about the fact that the price range for a week/month/year (choose the best option for you) for a particular currency pair is predetermined by the central bank look like some kind of another conspiracy theory.

What I still managed to find is such a thing as the Interbank Payment System. I already mentioned above that for each national or regional currency (as in the case of the euro) there is its own system of interbank payments. The functionality of such a system can be compared with the functionality of CLS — it allows its participants to send and receive payments within the local financial system.

The large US dollar payment system can generally be characterized as consisting of Fedwire (Real Time Gross Settlement System (RTGS) for the Federal Reserve Banks), CHIPS and several ancillary systems including DTCC, CLS, Fedwire Securities Service and the National settlement service (NSS).

CHIPS offers a general-purpose payment system used to settle customer payments or between banks throughout the day. In the first half of 2020, CHIPS cleared and settled approximately $1.68 trillion per day on behalf of 43 bank participants, averaging approximately 452,000 individual payments per day. It performs these tasks using its "balanced release mechanism", a set of procedures, algorithms and policies introduced back in 2000, along with the consistent improvements implemented since that time.

I mentioned the word “algorithm” for a reason. The fact is that, unlike Fedwire, which operates on the principle of RTGS (full-fledged exchange of gross value of payments), the work of CHIPS is based on the principle of netting. Since 43 member banks between themselves make about 400 thousand or more transactions per day through the system, it would be too much work for them to perform transactions in the gross value format (transfer the full amount within each transaction).

To make it clear, let's analyze this feature with an example. Bank of America, at the request of its client, must transfer the amount of $500 million to its counterparty from Europe at Crédit Agricole and receive €470 million in exchange. At the same time, another client of Crédit Agricole initiates the transaction in the opposite direction on the same day (let's assume that it is in the amount of $480 million) and at the same time expecting €450 million in return from its counterparty, whose account is opened in the same Bank of America (see infographic below).

Throughout the day, these are just a few of the possible hundreds/thousands of transactions between these banks, so moving half a billion in one currency or another back and forth each time would be a disaster in terms of providing such payments with liquidity. Banks simply would not have covered such a burden on their reserves. And this is where the CHIPS algorithms come into play, which, based on the netting principle, optimize the volume of payments between the participating banks of the system.

In the example above, this would look like a transaction from BoA to Crédit Agricole for $20m [= $500m - $480], and a reverse transaction from Crédit Agricole to BoA for €20m [= €470m - €450m]. In reality, the situation is much more complicated, since such relationships can be built simultaneously between several banks (3, 5, etc.) and hundreds of thousands of daily transactions are optimized using algorithms, reducing the necessary funds for the stable functioning of payments by an average of 20 times (find more about Liquidity Efficiency Ratio here). You can also find more details about the work of CHIPS and recent tests of its system in the material “CHIPS Review. Assessing the Efficiency of CHIPS: FNA Simulation prepared for The Clearing House” from January 2023.

Market Making

And perhaps the last thing I should mention in the context of the “all-powerful” algorithm is the concept of market making. Another misconception is that the market maker is the one to blame for chasing your stop loss.

It is true that market makers set prices for certain trading instruments, but in most markets, the main focus for market makers is to compete with each other caused by dependency on supply and demand. Now let's see why it is as it is.

There is an idea that market makers use a stop-hunt strategy, where they influence prices until the stop orders of many market participants are triggered, which causes the price to move in one direction or another. In regulated markets, such obvious price manipulations by them are prohibited and contrary to various rules and regulations (MiFID2 for example).

Some proprietary market makers use more aggressive strategies, but usually, these strategies involve exploiting weaknesses in the strategies of competing market makers. The main strategy is to follow the so-called neutral delta, in which the main focus is on making a profit not with price volatility, but due to the bid-ask difference. Like the counterparty to every trade in the FX market (in terms of pricing), market makers should be on the other side of your trade. In other words, whenever you sell, they must buy from you, and vice versa.

Thus, the main task of market makers is to maintain the functioning of certain markets, not through insidious manipulations, but by providing the proper amount of liquidity. Undoubtedly, achieving a sufficient level of “market depth”, especially in popular markets (gold, oil, currency and stock markets), requires algorithmization, but in order to allow you to experience fast entry and exit from transactions. Yep, boring.

Algorithms

And yet, what is very important to understand in the context of the issue of algorithms in the FX market is that the foreign exchange market has undergone significant structural changes in recent years. The proliferation of multiple marketplaces has increased fragmentation and trading has become more electronic and automated.

This has led to an increase in the use of so-called execution algorithms (EAs) of orders, including by banks and non-bank financial institutions, as well as some non-financial corporations.

The main reasons for the increasing use of market order execution algorithms are the reduction of trading costs while increasing transaction performance, reducing the impact on market quotes and the ability to access multiple liquidity pools simultaneously.

Large market participants cannot execute their positions immediately. They need to do so in profitable areas with sufficient liquidity to avoid additional transaction costs. Also, they often cannot fill all their orders at once, and for this reason, they will use the same areas with previously high execution volumes to refill their buy or sell orders there, which is the reason for the logic of retesting order blocks or inefficiencies.

Thus, in the example shown above, algorithms that are aimed at the immediate execution of an order are guided by all available liquidity in various places at a price better than that initially indicated by the client as the maximum allowable. An order to sell $60 million per yen is made using an algorithm that typically first evaluates the available liquidity on various trading platforms based on the limit orders in the market. In case of sufficient liquidity, the algorithm will instantly use up all available liquidity until the amount of the client's order is filled. In case of insufficient liquidity, the algorithm will have several options for filling the rest of the order, largely depending on the user's preferences regarding the urgency of execution and other input variables.

More examples of different algorithms and their practical use by market participants in order execution can be found in the 2020 report “FX execution algorithms and market functioning”, presented by a research group established by the Markets Committee of the BIS (Bank for International Settlements). Although it is three years old, this material is more than ever useful for the formation of a complete picture of order execution algorithmization.

Outro

Well, what we have now. In the world of financial trading, including the FX and securities markets, myths about the existence of one universal manipulating algorithm have become a common practice. From mentions on social media to active discussions in various communities, these stories have become part of the information agenda. Therefore, I consider it necessary to once again emphasize to you the value of critical thinking and the importance of your own research in such controversial issues (that is, DYOR).

Based on the analysis and verification of the above facts, we can say with confidence that this "holy grail", which is served in the form of a manipulating algorithm, simply does not exist in the Forex market. As I have said, often these mythical claims are created to attract attention, promote trading strategies and sell educational materials, offering only simplistic solutions that do not take into account the full range of factors that affect the market.

It is important to understand that financial markets are a complex system driven by many factors, including economic and geopolitical ones. The idea of a single algorithm capable of controlling and manipulating movements in a decentralized foreign exchange market is a priori contrary to the nature of this system. Such are the things.

See you later, alligators!✌🏻

P.s. Thank you for reading this article to the end. I would be more than happy if you could share your opinion about the topic or spread the materials to your folks👇🏻

Amazing work! 👏🏻